Mutares To Acquire Continental’s’ Drum Brakes Production & R&D Location In Italy

- By MT Bureau

- June 18, 2025

German private equity investor Mutares SE & Co is set to acquire Continental’s drum brakes production and R&D location in Cairo Montenotte (Italy) as part of its new platform investment in the automotive and mobility segment.

This follows the Continental Group’s recent announcement to spin off its automotive business as an independent company, Aumovio in September 2025.

As per the understanding, Mutares will take over all employees and business activities related to Continental’s drum brake business in Cairo Montenotte. This is expected to add about EUR 100 million in revenue for the company in 2025. The facility in Cairo Montenotte, Italy, is a production and R&D site for hydraulic drum brakes and manufactures products such as the Parking Brake for Simplex Brakes (EPB-Si) and the Drum Brake (Si). It employs around 400 people.

Johannes Laumann, CIO, Mutares, said, “With the acquisition of Continental’s Cairo Montenotte site we are strengthening our automotive and mobility segment. The long-standing expertise, strong product portfolio and highly skilled workforce provide an excellent foundation for operational development and future growth.”

Philipp von Hirschheydt, member of the Continental Executive Board and CEO of the future Aumovio, added, “We are confident that Mutares, with its extensive experience in the automotive business, is the right owner to lead this site into the future. Our shared goal is to ensure continuity for employees, customers and partners while securing long-term prospects for the Cairo Montenotte location.”

“With this agreement, we further consolidate our European manufacturing footprint. Moreover, it marks an important step in our strategy in Europe to better allocate R&D and investments with our product strategy and future technologies, such as electric braking or integrated friction solutions. The transaction deal follows Automotive’s strategy to sharpen our focus on our core business and streamline our business operations,” added Hirschheydt.

Harman Updates Ready Product Portfolio

- By MT Bureau

- January 14, 2026

Harman, a subsidiary of Samsung Electronics Co., has announced updates to its Ready product line and car audio offerings. These solutions are available for integration by automakers to manage hardware and software cycles and provide upgradeable vehicle experiences throughout the car's lifecycle.

The company focuses on execution across software, hardware and artificial intelligence. The updated portfolio is designed to address integration complexity and lifecycle costs for original equipment manufacturers (OEMs).

The updated toolchain includes Ready CQuence Loop for cloud-native validation across virtual and physical targets. It also features Ready CQuence Run, a Type-1 automotive hypervisor used for secure isolation in 20 million electronic control units (ECUs). For fleet management, the Ready Link Marketplace and Smart Delta technology support updates for over 80 million vehicles, offering access to 190 applications.

Harman has introduced Ready StreamShare, which utilises a Bluetooth hub and low-latency headphones to create four personalised media zones. This allows for individual listening and cabin conversation. The HALOsonic system provides electronic sound synthesis for vehicle signatures, while branded audio updates include Genre Optimiser and Smart Bass Impact to adjust cabin acoustics using AI.

The Ready Care system uses in-cabin intelligence to monitor driver and occupant vitals, including heartbeat detection. For external awareness, Ready Connect provides telematics supporting 4G, 5G and satellite communication. Ready Aware utilises vehicle-to-network (V2N) connectivity to provide hazard alerts, supported by machine learning to filter information and acoustic sensing to detect emergency vehicles.

The display range includes Ready Display, utilising Samsung Neo QLED technology. This is the first automotive display to receive HDR10+ certification. For the driver's line of sight, Ready Vision QVUE provides a windshield display featuring gaze-aware brightness tuning and eMirror Live View for navigation.

Christian Sobottka, Chief Executive Officer and President, Automotive Division, Harman, said, “In the vehicle, AI, Machine Learning and other emerging technologies are no longer a differentiator on their own. Execution is what wins. What sets Harman apart is our ability to orchestrate software, hardware, AI, audio, and visual technologies into holistic, road-ready experiences that meet consumer demand. With our integrated product portfolio and advanced developer tools, we’re helping OEMs solve key challenges like integration complexity and lifecycle costs, so that they can deliver rapid, consumer‑focused innovation across evolving vehicle platforms that bring their customers genuine delight behind the wheel.”

Bolt.Earth And Statiq Partner To Enable Interoperable EV Charging

- By MT Bureau

- January 08, 2026

Bolt.Earth and Statiq have announced a strategic partnership to enhance electric vehicle (EV) charging access across India. The collaboration focuses on interoperability, allowing four-wheeler users to access more charging options through a unified system.

Under the agreement, EV drivers can locate, access, and pay for chargers on both the Bolt.Earth and Statiq networks using either company's mobile application.

The partnership integrates Statiq’s DC fast-charging infrastructure for four-wheelers with Bolt.Earth’s platform. This expansion targets key cities and highways to assist with intercity travel and range anxiety.

Statiq operates a network that includes both AC and DC fast-charging solutions in urban centres and commercial hubs. Bolt.Earth provides a peer-to-peer (P2P) charging platform serving two-wheeler, three-wheeler, and four-wheeler vehicles across more than 1,900 cities.

Akshit Bansal, Founder & CEO, Statiq, said, “At Statiq, our vision has always been to make public charging simple, reliable and widely accessible. Partnering with Bolt.Earth enables us to connect two strong networks and providing EV drivers with more fast-charging options through a seamless experience. By reducing the need for multiple apps and bringing more chargers onto a unified journey, we’re taking a meaningful step towards an open, interoperable charging ecosystem that supports faster EV adoption across India.”

S Raghav Bharadwaj, CEO & Founder, Bolt.Earth, said, “Interoperability is the future of EV charging in India, and this partnership is a decisive step toward that future. By uniting Bolt.Earth’s universal network with Statiq’s robust, fast-charging infrastructure, we’re delivering unmatched accessibility and convenience to EV users. This integration aims to ease range anxiety, eliminate the hassle of multiple apps, and provide a single, real-time view of available charging points—making EV charging seamless, reliable, and user-friendly.”

Toyoda Gosei Commercialises Automotive Parts With Increased Recycled Rubber

- By MT Bureau

- December 26, 2025

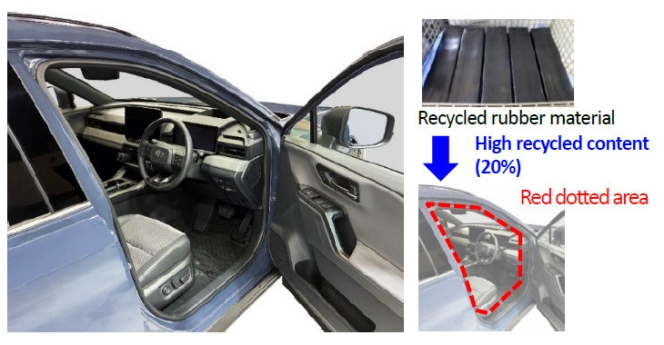

Japanese automotive component supplier Toyoda Gosei Co, has launched automotive weatherstrips containing a higher percentage of recycled rubber. The components have been adopted for the Toyota Motor RAV4, with plans to expand the application of this technology to other models.

While recycling processes for steel and plastic are established, rubber has historically been incinerated for energy recovery due to the complexities of devulcanisation. This process uses heat and pressure to break the sulphur bonds that provide rubber with elasticity; however, it often weakens the material and creates odours.

Toyoda Gosei has modified its proprietary devulcanisation technology to improve the quality of regenerated rubber. These refinements have allowed the company to increase the recycled content in automotive parts from under 5 percent to 20 percent. The achievement received a Project Award from Toyota Motor.

The company is now working to apply these techniques to:

- Synthetic Rubber: Expanding use in products such as rubber hoses.

- Natural Rubber: Developing processes for materials used in higher volumes across the industry.

The company intends to collaborate with vehicle manufacturers to establish a system for collecting and regenerating rubber from end-of-life vehicles. This circular model aims to reduce carbon emissions and improve resource circulation within the automotive supply chain.

Toyoda Gosei stated that by leading rubber recycling efforts, it seeks to address long-standing industry challenges regarding waste management and material strength in recycled elastomers.

- Greenfuel Energy Solutions

- Lumax Auto Technologies

- LATL

- Maruti Suzuki India

- CNG

- WEH Gas Tech

- Deepak Jain

- Anmol Jain

- Akshay Kashyap

Greenfuel Energy Solutions Starts Ferrule-less Tube Production In Manesar

- By MT Bureau

- December 22, 2025

Greenfuel Energy Solutions, a subsidiary of Lumax Auto Technologies (LATL), has opened a manufacturing line for ferrule-less tubes and fittings at its Manesar facility. The line was inaugurated by the leadership team of Maruti Suzuki India.

The project involves an initial investment of INR 250 million, with a further INR 500 million planned over the next five years. The facility has the capacity to supply components for approximately 100,000 vehicles, with production ramping up in phases.

The facility localises the production of ferrule-less tubes and fittings for CNG vehicles, a technology that was previously imported. The solution uses torque-tightened assembly for mass production. Greenfuel developed the line in collaboration with its German partner, WEH Gas Tech, adapting the technology for Indian conditions.

Deepak Jain, Director, Lumax Auto Technologies, said, “The localisation of this technology reflects our strong commitment to the ‘Make in India’ agenda. By bringing critical manufacturing capabilities onshore, we are accelerating technology transfer, strengthening domestic supply chains, and enhancing India’s competitiveness in advanced automotive manufacturing.”

Anmol Jain, Managing Director, Lumax Auto Technologies, added, “This initiative lays the foundation for scalable and sustainable growth. It improves operational efficiencies, deepens collaboration with OEM partners, and enables faster validation cycles supporting the evolution of Indian manufacturing towards higher value-added capabilities.”

The transition to domestic manufacturing is intended to reduce reliance on global supply chains and eliminate costs associated with import duties and foreign-exchange exposure.

Akshay Kashyap, MD & CEO, Greenfuel Energy Solutions, said, “We are the first and only company in India to localise ferrule-less tubes and fittings along with the underlying manufacturing technology. This Make-in-India solution offers ease of installation, reduced labour costs, and enhanced safety for the automotive industry. We have already commenced supplies to a leading OEM and are witnessing strong interest from others.”

“This technology has been proven in Europe and used by an established German automotive brand for over seven years. We have successfully indigenised it in India in collaboration with our long-standing German partner, WEH Gas Tech, a relationship spanning nearly two decades. While the core line was sourced from Germany, it has been adapted and optimised for Indian operating conditions, combining global credibility with local engineering expertise,” added Kashyap.

In 2024, Lumax Auto Technologies Limited acquired a 60 percent stake in Greenfuel Energy Solutions’ alternate fuels business for INR 1.53 billion. The division reported revenues of INR 1.7 billion in the first half of the year and maintains an order book of approximately INR 2 billion. The expansion aligns with the industry-wide shift toward alternate-fuel platforms in India.

Comments (0)

ADD COMMENT