Sundram Fasteners Limited Reports Highest Ever Consolidated Net Profit

- By MT Bureau

- November 06, 2024

The board of directors of Sundram Fasteners Limited has announced the unaudited financial results for the quarter and half-year ended 30 September 2024.

The revenue from operations was recorded at INR 12.88 billion during the second quarter of FY2024-25 as compared to INR 12.31 billion in the corresponding quarter of last fiscal.

The domestic sales for the quarter ended 30 September 2024 were of INR 8.60 billion as compared to Rs 8.59 billion during the corresponding quarter in the last fiscal.

The export sales for the quarter ended 30 September 2024 were INR 3.89 billion as compared to INR 3.37 billion during the corresponding period in the last fiscal, marking a growth of 15.4 percent.

The company registered an EBITDA of INR 2.25 billion during the quarter ended 30 September 2024 as compared to an EBITDA of INR 2.05 billion in the corresponding period of last fiscal.

The export led growth and stable commodity prices contributed to the expansion of EBITDA margins from 16.6 percent to 17.3 percent.

The Profit before Tax (PBT) for the quarter ended 30 September 2024 was INR 1.75 billion as compared to INR 1.58 billion during the corresponding period in the last fiscal, registering an increase of 11.0 percent.

The net profit for the quarter ended 30 September 2024 was at INR 1.30 billion as compared to INR 1.18 billion during the corresponding quarter of last fiscal, registering an increase of 10.5 percent.

Earnings per share for the quarter ended 30 September 2024 amounted to INR 6.22 as compared to INR 5.63 in the corresponding period last fiscal.

The Company has incurred INR 2.38 billion as capital expenditure for the half-year ended 30 September 2024, in line with its planned capital expenditure of INR four billion for FY2024-25. These investments will help the company to scale in non-auto, EV, hybrid and adjacent spaces, according to the company sources.

The Company has incurred INR 2.38 billion as capital expenditure for the half-year ended 30 September 2024, in line with its planned capital expenditure of INR four billion for FY2024-25. These investments will help us scale in non-auto, EV, hybrid and adjacent spaces, according to the company sources.

Consolidated Financials

The Company’s consolidated revenue from operations posted for the quarter ended 30 September 2024 was INR 14.86 billion as compared to INR 14.21 billion during the corresponding quarter of last financial year.

The consolidated net profit for the quarter ended 30 September 2024 was INR 1.43 billion compared to INR 1.33 billion during the corresponding period in the last fiscal.

The consolidated earnings per share (EPS) for the quarter ended 30 September 2024 amounted to INR 6.78 as compared to INR 6.28 in the corresponding period last fiscal.

H1 FY2024-25 results

The revenue from operations was at INR 25.99 billion for the half-year ended 30 September 2024 as compared to INR 24.48 billion during the corresponding period in the last fiscal.

The domestic sales for the half-year ended 30 September 2024 were at INR 17.16 billion as compared to INR 16.82 billion in the corresponding period of the last fiscal.

The export sales for the half-year ended 30 September 2024 were INR 8.11 billion as compared to INR 6.85 billion during the corresponding period in the last fiscal, registering a growth of 18.5 percent.

The net profit for the half-year ended 30 September 2024 was at INR 2.62 billion compared to a net profit of INR 2.31 billion during the corresponding period in the previous fiscal, registering an increase of 13.5 percent.

The company’s consolidated revenue from operations posted for the half-year ended 30 September 2024 was INR 29.83 billion as compared to INR 28.32 billion during the same period in the previous fiscal. The consolidated net profit for the half-year ended 30 September 2024 was INR 2.86 billion as compared to net profit of INR 2.61 billion during the same period in the previous fiscal.

The board at its meeting held today declared an interim dividend of INR 3.00 per share (300 percent) for FY2024-25.

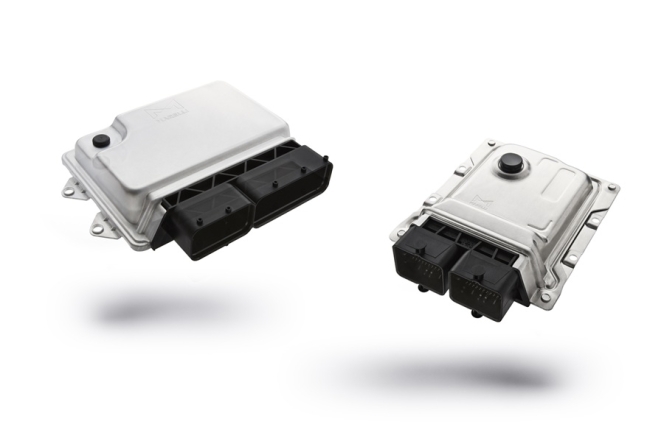

Marelli Launches New ECU For Petrol, Flex Fuel And CNG For India, Brazil & EMEA Markets

- By MT Bureau

- March 11, 2026

European automotive component supplier Marelli has launched its new generation Port Fuel Injection Engine Control Units (PFI ECUs) for petrol, flex fuel (ethanol, methanol and synthetic fuels) and Compressed Natural Gas (CNG) applications, specifically targeting the India, Brazil and EMEA markets.

The ECUs are designed, validated and produced locally in each region. This portfolio utilises Marelli’s 20-year history in flex fuel and bi-fuel technologies to address regional vehicle architectures and emission regulations.

The new ECUs incorporate the Infineon AURIX TC3x automotive microcontroller to manage multitasking and processing. The hardware and software are built to support calibration, homologation and customer-specific tuning.

Key technical features include:

- Processing: Integration of Infineon’s AURIX TC3x for reliability and fast processing.

- Architecture: Open system allowing third-party applications and Firmware Over-the-Air (FOTA) updates.

- Safety & Security: Compliance with ISO 26262 ASIL D functional safety standards and anti-tuning protection.

- Control Channels: Up to eight gasoline injector drivers and four CNG injector drivers.

- Diagnostics: OBDII diagnostics and wide-range O2 Universal Exhaust Gas Oxygen (UEGO) sensors for air/fuel ratio monitoring.

By localising production and R&D, Marelli aims to provide automakers with reduced costs and faster implementation times. The units manage all engine requirements, including integrated combustion algorithms and emission control strategies to meet local regulatory standards.

Giovanni Mastrangelo, Head of R&D for Marelli's Propulsion business, said, "As adoption speeds for propulsion technologies vary, Marelli continues to support customers across the powertrain spectrum. In markets where internal combustion engines remain relevant, our new engine control units enable greater efficiency, emissions reduction, and versatility. This reflects our system-driven approach and know-how in vehicle control, conventional and alternative fuel injection technologies and transmission systems.”

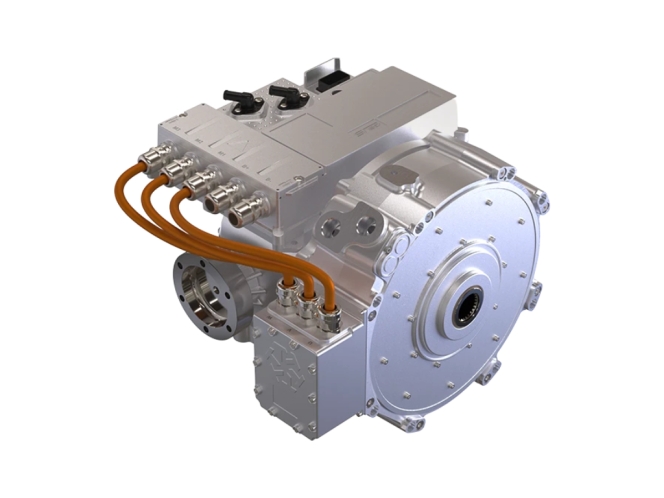

Minda Corporation, Turntide Technologies Form JV For EV & Hybrid Powertrains

- By MT Bureau

- March 10, 2026

Minda Corporation, the flagship of Spark Minda, has signed a strategic joint venture agreement with Turntide Technologies to develop and manufacture powertrain solutions for electric and hybrid vehicles in India.

Under the terms of the agreement, which is subject to regulatory approval, Turntide will hold a 51 percent stake in the venture, while Minda Corporation will hold 49 percent through a wholly owned special purpose vehicle (SPV).

The joint venture company will focus on the development of several components for the Indian EV segment including high-voltage and high-performance electric motors; high and low-voltage motor controllers and customised units. Pumps for thermal applications in electric vehicles.

The partnership is intended to localise Turntide’s technology, providing products that meet the requirements of domestic original equipment manufacturers (OEMs). The venture aims to reduce development cycles and strengthen the local supplier ecosystem while utilising Minda Corp’s manufacturing presence in India.

Ashok Minda, Chairman and Group CEO, Minda Corporation, said, “This partnership with Turntide marks a significant milestone in our journey towards electrification. By combining Turntide’s globally proven technology with Minda Corporation Limited’s strong local presence, we aim to deliver advanced, high-quality, and cost-competitive EV powertrain solutions that support India’s transition to sustainable mobility. This will result to meet ‘Make in India’ objectives and enhance the resilience of domestic supply chain of EV ecosystem.”

Steve Hornyak, CEO, Turntide Technologies, added, “India’s electrification growth story is central to Turntide’s strategy, and this joint venture is a key step in bringing our powertrain technologies closer to customers in the market. We’re proud to partner with Minda Corporation, a fantastic team with decades of experience serving global OEMs, as we deliver localised, high-performance solutions for India’s rapidly evolving mobility ecosystem.”

Toyoda Gosei Completes Acquisition Of Ashimori Industry

- By MT Bureau

- March 04, 2026

Toyoda Gosei Co., has acquired all shares of Ashimori Industry Co., effective 1 March 2026 and has now completed the process of making Ashimori Industry its wholly-owned subsidiary.

The acquisition follows a capital and business alliance agreement established in May 2021. In November 2023, Toyoda Gosei made Ashimori Industry an equity-method affiliate to integrate product development, sales, procurement and production.

Toyoda Gosei intends to operate as a supplier of safety systems by combining its airbag technologies with Ashimori Industry’s seatbelt products. The company aims to facilitate the development of protection systems that use both components to reduce traffic fatalities.

The move will enable expediting management resource allocation in the safety systems division. It will further promote integrated control systems for airbags and seatbelts to meet market demand.

The deal also focuses on the growth of Ashimori Industry’s functional products business, specifically the PALTEM (Pipeline Automatic Lining SysTEM) method. This technology is used for the rehabilitation of aging pipeline infrastructure, a sector currently experiencing rising demand.

For the unversed, established in December 1935, Ashimori Industry reported revenue of USD 537 million in March 2025. It employees 2,358 people and is involved in the manufacturing of seatbelts, airbags, synthetic rope and pipe rehabilitation systems.

Toyoda Gosei stated that the move is designed to maximise synergies and address societal challenges related to infrastructure and road safety.

Adient Introduces Sculpted Soft Trim Technology For Automotive Seating

- By MT Bureau

- February 26, 2026

Adient, a supplier of automotive seating, has launched Sculpted Soft Trim, a manufacturing technology designed to provide new design options for vehicle interiors. The product is a breathable, formed trim solution that can be applied to large panels or components such as armrests, headrests and child seat anchor covers.

The technology uses an automated forming process to create shapes, reducing the requirement for traditional manual sewing. This method allows for the creation of concave surfaces and 3D shapes that were previously difficult to execute using standard cut-and-sew techniques.

Sculpted Soft Trim is designed to improve craftsmanship while lowering labour requirements. In applications such as rear seat child anchor locations, the system can replace up to twelve individual patterns and sew lines with a single formed component.

Key features of the technology include:

- Material Compatibility: Support for a range of fabrics and vinyl materials.

- Surface Detail: Capability to achieve 3-dimensional concavity without losing grain detail.

- Customisation: Ability to add embossed or debossed textures, graphics and badging within the same tooling process.

- Material Integration: Facility to pre-sew and form dissimilar materials together.

- Firmness Control: Variable firmness options to meet specific application requirements.

Adient has confirmed that Sculpted Soft Trim is available globally. The technology is scheduled to enter production on vehicles from several original equipment manufacturers (OEMs) during 2026. According to the company, the process reduces cycle times by approximately 50 percent compared to traditional forming methods.

Mike Maddelein, Vice-President of engineering in the Americas, Adient, said, “Sculpted Soft Trim fundamentally changes what’s possible in seat trim design by combining premium aesthetics with meaningful manufacturing efficiency. With cycle times reduced to roughly 50 percent of traditional forming methods, this technology delivers both speed and quality. In addition, decorative sewing, quilting and embossed or debossed features introduce another level of specialisation, all executed with tight tolerance control to ensure consistent, high-end craftsmanship at scale.”

Comments (0)

ADD COMMENT