Kuka bets on flexible production and logistics solutions

- By Bhushan Mhapralkar

- August 12, 2021

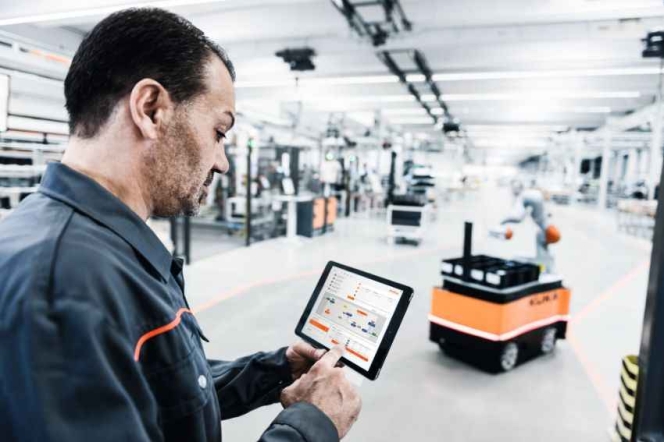

Supporting a smart manufacturing shift across industry sectors by offering robot systems, Automated Guided Vehicles (AGVs), mobility solutions (mobile platforms, mobile robots etc.) and technologies (arc welding, assembly, bonding and sealing, die casting, extrusion etc.), Kuka is confident of its new operating ecosystem iiQKA significantly simplifying robot use. Forming the base of an entire ecosystem that provides access to a powerful selection of components, programmes, apps, services and equipment that are easy to install, operate and use, iiQKA is designed and developed to facilitate newcomers to implement automation without specialised training. Also announcing the upgradation of its simulation software Kuka.Sim.4.0, Kuka is confident of automation benefitting in the medium-term against Covid-19 disruption. As per Peter Mohnen, CEO, Kuka AG, automation can be beneficial in the medium-term against the Covid-19 disruption for manufacturers rethinking their vulnerable, globally networked production and supply chains.

Big shift to flexible automation systems

Stating in his address to the shareholders in the 2020 annual report that the company implemented a cost-cutting drive and focused on a stable financial position, Mohnen averred that Kuka was one of the very few ‘full-range’ suppliers. Keeping a close eye on the developments taking place across the world markets that it is presently in, the company – with sales revenues of EUR 2.6 billion and an employee strength of 14,000 – is confident of its Kuka.Sim.4.0 software to help reach a new level of planning reliability, simplicity and cost efficiency. Stressing on the upgraded software facilitating easy offline programming of the robot and fast cycle time analysis, Kuka is anticipating a big shift to flexible automation solutions with quickly adaptable production cells instead of rigid systems. It is highlighting the prowess of Kuka.Sim.4.0 software in its ability to support the import of CAD data that aids configuration of safety spaces graphically in 3D and to simulate the stopping behaviour of robots.

Affected in 2020 as projects were postponed or abandoned completely, Kuka is of the view that the auto industry is facing a fundamental structural transformation that offers opportunities but poses enormous challenges at the same time. Confident that the Kuka.Sim.4.0 software will particularly aid components suppliers with its ability to facilitate the planning of robot applications across industry sectors, including auto, the company is looking at a growing use of new technologies such as AGVs and AI-based software solutions. Helped by China’s auto industry’s tremendous thrust on robot installation since 2016 in terms of growth, Kuka is banking on the upgraded software’s capability in significantly reducing the area required by a cell. Roland Ritter, Portfolio Manager, Kuka AG, mentioned that it also contains a new robot language called the ‘Kuka Robot Language’ (KRL), which provides two user views for programming the robot. One view is for the experts and the other is for beginners. Ensuring same data is being worked upon by the virtual controller and the real controller, the Kuka.Sim.4.0 supports the new KR Scara and KR Delta robots from its manufacturer. It also assures 100 percent data consistency.

Features, and more features

Aiding the creation of a customised component library using own CAD data along with Kuka.Sim.Modeling add-on, the Kuka.Sim.4.0 software is also supported by a new ‘Connectivity’ add-on that allows users to commission the cell virtually and create a digital twin for greater planning reliability and the best possible implementation. Interestingly, the customised component library could be as kinematic systems, sensors, material flow or physical behaviour. Using behavioural emulators such as WinMOD and SIMIT, the software, with the Arc Welding add-on, aids users to speed up their offline programming for welding applications. The approach positions or the optimum orientation of the robot for the welding process can be defined, for example. A big advantage of the new software, according to Ritter, is export possibilities. Integrators, he adds, will benefit from the ability to export the simulation as a 3D PDF, which can be simply opened with an Acrobat Reader.

Detailed information in 2D for mechanical commissioning can also be provided via the export feature. One of the highlights of this is product presentation using a virtual reality headset. Tablets and smartphones also deliver impressive simulation results on the go via the Mobile Viewer app, informs Ritter. Signing a major contract with Daimler to supply four-figure number of robots and linear units (KR Fortec and KR Quantec), and other Kuka technologies such as software and controllers, the company has maintained a positive outlook despite Covid-19. Working towards strengthening its position as a global player, Kuka is driving the goal of making automation available to everyone. Looking at conquering new areas and new markets, it is stressing on the potential for cobots – sensitive robots – in the auto industry.

- Recreatives Industries

- MAX Amphibious Vehicles

- All-Terrain Vehicles

- TRL Outdoors

- Muddog Amphibious Vehicles

Recreatives Industries Partners With TRL Outdoors To Accelerate MAX Dealer Network Growth

- By MT Bureau

- March 08, 2026

Recreatives Industries, the company behind the iconic MAX 6x6 Amphibious All-Terrain Vehicles, has announced a new partnership aimed at broadening its market reach. The manufacturer has signed a national representation agreement with TRL Outdoors LLC, known for Muddog Amphibious Vehicles. This collaboration is designed to accelerate the growth of the MAX dealer network while reinforcing the brand's ongoing push into utility, industrial and commercial sectors.

As per the agreement, TRL Outdoors will represent the full range of MAX vehicles across the entire country. The move is intended to strengthen nationwide coverage and foster a more structured and sustainable expansion of the dealer base. The representatives bring significant industry experience to the table, having previously worked with manufacturers of high-end industrial amphibious vehicles, whose prices often started well above USD 100,000. This background positions them to effectively introduce the more cost-effective MAX platforms to a market accustomed to substantially higher-priced equipment.

The agreement includes a framework of quarterly performance goals focused on integrating new dealers, increasing market share and enhancing brand visibility. This structured approach is intended to ensure growth is both disciplined and sustainable. With the upcoming availability of models like the MAX 4 and Buffalo, the company is confident that TRL Outdoors will be instrumental in penetrating new sectors. The core strategy hinges on offering capable amphibious performance at a price point significantly lower than many established industrial alternatives. This partnership represents a key step in the company's broader plan to solidify its dealer network and secure long-term, measured growth.

Andrew Lapp, CEO, Recreatives Industries, said, “This agreement aligns with our strategy of expanding deliberately and building a high-quality dealer network. TRL Outdoors has firsthand experience selling premium amphibious vehicles into demanding commercial environments. Their understanding of dealer development, combined with MAX’s proven designs and compelling value proposition, positions us well as we expand into new regions and applications.”

LKQ SYNETIQ’s Annick Jourdenais Rejoins Auto30Club On International Women’s Day

- By MT Bureau

- March 08, 2026

Annick Jourdenais, Managing Director at LKQ SYNETIQ, marked International Women’s Day by rejoining the Automotive 30% Club (Auto30Club) as a Patron Gold member. A longstanding advocate for the organisation’s objectives, her renewed affiliation arrives at a critical juncture as the automotive industry contends with the challenges of electrification and sustainability. Her involvement underscores the critical need for greater female representation in senior leadership roles.

Jourdenais emphasises that the profound transformation occurring within the sector requires innovative thinking and collaborative leadership to build future-ready businesses. Central to this vision is enhancing diversity at the highest levels. At LKQ SYNETIQ, a joint venture focused on circular economy principles, the mission involves responsibly processing end-of-life vehicles and promoting recycled original equipment parts to reshape the automotive lifecycle. Success in this area depends on cohesive strategy among insurers, repairer and supply chain partners, as well as teams enriched by diverse viewpoints.

The company’s long-term strategy is built on developing capability, strengthening operational excellence and fostering a culture that encourages both challenge and innovation. Jourdenais views diversity not as an isolated objective but as integral to improving decision-making, building resilience and ensuring sustainable growth. Beyond her operational duties, her role on the European Women’s Network Steerco allows her to actively support career progression and representation across the business.

While acknowledging the positive momentum across the industry, she stresses that genuine advancement demands persistent effort and collective responsibility. Having first championed the business’s membership during her tenure as CFO at LKQ UK & Ireland, continuing this dedication in her current position holds significant personal meaning. She looks forward to collaborating with fellow Patrons to help cultivate an automotive sector that is both innovative and truly reflective of the diverse talent within it.

Jourdenais said, “The automotive sector is at a defining point. As we respond to electrification, resource pressures and rising sustainability expectations, we have an opportunity to redesign not only how vehicles are built and repaired but how our industry is led. Diverse leadership is fundamental to delivering that long-term transformation. I’m proud to re-join the Automotive 30% Club as a Patron at such a pivotal time for our sector. The scale of change underway across automotive demands bold thinking, collaborative leadership and a commitment to building organisations that are fit for the future. Increasing representation at senior levels is central to that ambition.”

LKQ SYNETIQ Appoints Justin Elliot As Sales Director To Lead Commercial Growth

- By MT Bureau

- March 07, 2026

LKQ SYNETIQ, a leading entity in the UK vehicle dismantling and recycling sector, has appointed Justin Elliot as its new Sales Director. In this capacity, he will be responsible for advancing the company's commercial strategy and fostering market development. Elliot brings over 13 years of extensive experience within the LKQ group, Europe's foremost provider of vehicle parts and services. His background includes several senior directorial roles within the organisation's Bodyshop Division. He will retain his European strategic responsibilities as Head of Collision and Coating – Strategy & Innovation for LKQ Europe, alongside his new duties.

The company itself is a joint venture established this year between LKQ Europe and SYNETIQ Ltd, an IAA company. This collaboration merges LKQ's robust distribution network and aftermarket knowledge with SYNETIQ's proficiency in dismantling, reuse and remanufacturing. In 2024, this partnership resulted in the dismantling of approximately 27,000 vehicles across four UK locations. In his new role, Elliot is tasked with executing the sales strategy, concentrating on enhancing relationships with clients, supporting business growth and uncovering new opportunities within the repair and insurance markets. He will collaborate closely with marketing, operations and other teams across the wider LKQ structure to ensure a unified approach to the market and to scale the availability of recycled Original Equipment parts.

His appointment represents a significant step in the venture's ongoing efforts to expand its sustainable parts offering, enabling workshops, bodyshops and insurers to lower costs and minimise their environmental footprint throughout the repair process.

Annick Jourdenais, Managing Director, LKQ SYNETIQ, said, “Justin is a great addition to the LKQ SYNETIQ team, and his experience across the group will be invaluable as we continue to strengthen customer partnerships and support the growth of our recycled OE parts offering.”

Elliot said, “LKQ SYNETIQ has a significant opportunity to reshape how recycled OE parts are brought to market, supporting customers with solutions that are both commercially competitive and sustainable at scale. I’m looking forward to getting started in this role, with a focus on strengthening our sales execution and ensuring we are fully leveraging the capabilities across LKQ and SYNETIQ to expand our reach, unlock new customer segments and deliver a consistent approach to market.”

- SANY India

- National Academy of Construction

- NAC

- SANY SY120

- Sanjay Saxena

- Madhusudan Katragadda

- Madhura Engineering

SANY India And NAC Complete First All-Women Excavator Training Batch

- By MT Bureau

- March 07, 2026

SANY India, one of the leading heavy machinery manufacturers, and the National Academy of Construction (NAC) have concluded the first all-women excavator operator training programme in India. A batch of 22 women trainees received their professional certifications at a ceremony held on 6 March 2026 at the NAC facility in Pulivendula.

The initiative provided technical instruction on the SANY SY120 excavator. SANY India facilitated the machinery, designed the training syllabus and certified the NAC instructors to ensure the programme met industry requirements.

The curriculum focused on hands-on operation and global best practices for infrastructure equipment. Participants were evaluated and certified under the Infrastructure Equipment Skill Council (IESC) framework.

Key programme components included:

- Technical Instruction: Training on the operation and maintenance of the SANY SY120.

- Trainer Validation: NAC faculty members were trained and certified by SANY India prior to the programme.

- Employment Support: NAC will provide placement assistance to the 22 graduates for roles in the construction sector.

- Standardisation: Alignment with IESC certification to ensure nationwide employability.

The completion of the programme was timed to coincide with International Women's Day. Representatives from SANY India and the NAC attended the handover ceremony to mark the transition of the trainees into the professional workforce.

Sanjay Saxena, COO, SANY India, said, “At SANY India, we believe true progress is inclusive. By empowering women with world-class skills and certification, we are not only shaping careers but also strengthening India’s construction ecosystem. This Women’s Day-aligned batch symbolises opportunity, confidence and capability.”

Madhusudan Katragadda, Dealer Principal at Madhura Engineering, added, “It is truly an honour to be part of such a historic initiative. I sincerely appreciate SANY India and the National Academy of Construction for taking this bold step toward empowering women in the construction equipment industry. Excavator operations have traditionally been a male-dominated field, and this programme marks the first step in changing that narrative. Seeing these talented women successfully complete their training fills us with pride and optimism for the future of the industry. I encourage all the trainees to continue learning and growing – this certification is just the beginning. With dedication and experience, they can explore many opportunities within the sector, including roles in operations, sales and service engineering.”

Comments (0)

ADD COMMENT