- two-wheeler

- 2W

- sales

- performance

- Honda

- Suzuki

- Yamaha

- Royal Enfield

- Hero

- Bajaj

- November 2024

- year on year

Two-wheeler Sales Performance In November 2024

- By MT Bureau

- December 04, 2024

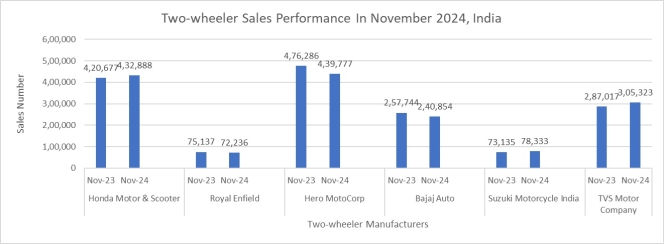

Honda Motorcycle & Scooter India (HMSI) dispatched 4,72,749 units in November 2024. Of these, 4,32,888 units accounted for domestic sales, an increase of three percent when compared to the sale of 4,20,677 vehicles in November 2023. The company exported 39,861 units in the respective month.

Royal Enfield sold 72,236 units in the domestic market in India in November 2024 marking a decrease of four percent when compared to the sale of 75,137 vehicles in November 2023. The two-wheeler major exported 10,021 units in November, up 96 percent as compared to the export of 5,114 vehicles in November 2023.

Hero MotoCorp sold 459,805 units in November 2024 marking a 6.36 percent decrease when compared to the sale of 491,050 vehicles in November 2023. Domestic sales in November 2024 were 439,777 vehicles, down 7.66 percent when compared to the sale of 476, 286 units in November 2023. Exports saw a growth of 35.65 percent increase with 20,028 units dispatched in comparison to 14,764 units dispatched in November 2023.

At 4,21,640 units in November 2024, Bajaj Auto has announced a five percent increase in total sales year-on-year. In the domestic market, the company saw a sales decline of seven percent at 2,40,854 units. In November 2023, it sold 2,57,744 vehicles.

At 1,80,786 units, the two-wheeler major witnessed a 24 percent rise in exports in November 2024. In November 2023, it exported 1,45,259 vehicles.

Suzuki Motorcycle India Pvt Ltd achieved a total sale of 94,370 vehicles in November 2024, up eight percent when compared to the sale of 87,096 units in November 2023.

The domestic sale in November 2024 stood at 78,333 units, up seven percent when compared to the sale of 73,135 units in November 2023. Exports grew 15 percent at 16,037 units in November 2024 as compared to 13,961 units in November 2023.

TVS Motor Company registered a total sale of 401,250 units in November 2024, an increase of 10 percent when compared to the sale of 364,231 units in November 2023. Of these, 392,473 two-wheelers were sold in November 2024 respectively, marking a 12 percent increase in two-wheelers with the sale of 352,103 units in November 2023. In November 2024, 8,777 three-wheelers were sold marking a modest decline when compared to the sale of 12,128 units in November 2023.

In the domestic market, the two-wheeler business of TVS Motor Company witnessed a four percent growth with the sale of 305,323 units. In November 2023, the company sold 287,017 units. The motorcycle category saw a growth of four percent with the sale of 189,247 vehicles as compared to the sale of 172,836 units in November 2023. Scooter witnessed a growth of 22 percent with the sale of 165,535 units in November 2024 as compared to the sale of 135,749 vehicles in November 2023.

The company recorded a 57 percent growth in electric vehicles with a sale of 26,292 units in November 2024 as compared to the sale of 16,782 vehicles in November 2023. The iQube e-scooter has been a big success, steadily closing the gap with e-scooter market leader Ola Electric’s offerings in the same category.

TVS Motor Company exported 93,755 units in November, clocking a growth of 25 percent year on year when compared with the sale of 75,204 units in November 2023.

India Auto Wholesales Clock 30% Growth In February

- By Nilesh Wadhwa

- March 13, 2026

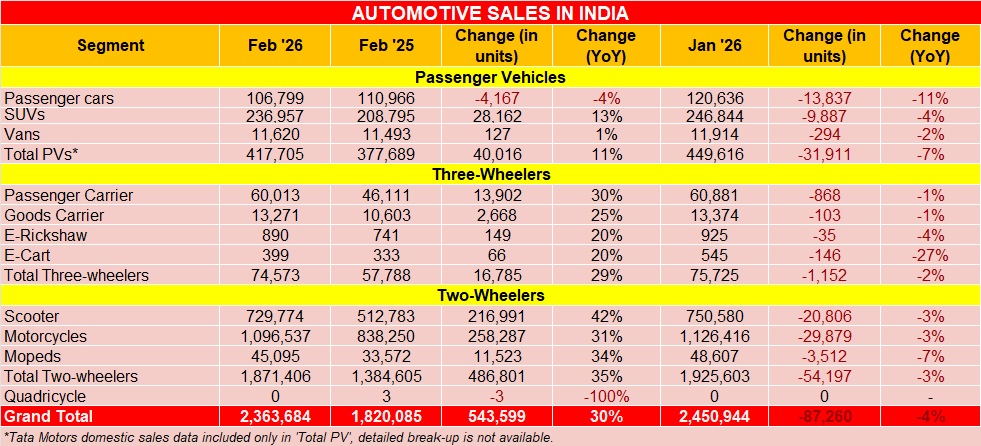

The automotive industry witnessed its best-ever sales for the month of February with a record 2.36 million vehicles sold across categories last month, which marks a 30 percent YoY growth as per the latest data shared by the Society of Indian Automobile Manufacturers (SIAM). For context, in February 2025, a total of 1.82 million vehicles were sold.

The two-wheeler segment reported a 35 percent YoY growth with sales of 1.87 million units, as compared to 1.38 million units last year. The performance was driven across categories – scooters (+42 percent), motorcycles (+31 percent) and mopeds (+34 percent).

The three-wheeler segment saw a 29 percent uptick with sales of 74,573 units, as against 57,788 units last year.

The passenger vehicle segment continued to witnessed a double-digit uptick with SUVs witnessing a robust demand. A total of 417,705 passenger vehicles were sold last month, as compared to 377,689 units a year ago. SUVs with 13 percent YoY growth continue to drive the momentum for the segment.

Rajesh Menon, Director General, SIAM, said, “Positive sentiments in the industry continues as passenger vehicles, two-wheelers and three-wheelers posted their highest ever Sales of February in 2026, with double-digit growth, compared to February 2025. While the month of March has festive drivers in several parts of the country, the recent conflict in West Asia remains a concern, both from the perspective of the supply chain, which could impact the manufacturing processes and exports. Industry would keep a close watch on evolving Geopolitical developments.”

Milan Nedeljkovic Elevated To BMW Board, Raymond Wittmann To Head Production

- By MT Bureau

- March 12, 2026

The Supervisory Board of German luxury brand BMW AG has appointed Raymond Wittmann to the Board of Management. He will assume responsibility for Production on 13 May 2026.

The appointment also coincides with Milan Nedeljkovic becoming Chairman of the Board of Management.

Wittmann joined the BMW Group in 2015 and has led Corporate Strategy and Corporate Development since 2024. His previous roles include Head of Assembly at the Munich plant, CFO of the Americas sales region, and Project Manager for the production site in San Luis Potosí, Mexico. He holds a PhD in aerospace engineering and previously worked as a partner at a consultancy.

Dr. Nicolas Peter, Chairman, Supervisory Board of BMW AG, said, “Raymond Wittmann combines strategic thinking with operational excellence and business responsibility. With his broad, cross-divisional experience and international perspective, he has the key qualities for leading the production division.”

“Raymond Wittmann complements the future Board of Management team led by Milan Nedeljkovic with the right strengths and skills. The Supervisory Board is very confident that the Board of Management, in its new composition, will continue to drive the success of the BMW Group in the future,” said Dr. Peter.

IEA Member Countries To Release 400 Million Barrels Of Oil From Emergency Reserves

- By MT Bureau

- March 11, 2026

The 32 member countries of the International Energy Agency (IEA) have agreed to release 400 million barrels of oil from emergency reserves. This collective action is intended to address market disruptions resulting from the conflict in the Middle East that began on 28 February 2026.

The decision follows an extraordinary meeting of IEA governments to assess global supply conditions. Exports of crude and refined products through the Strait of Hormuz have fallen to less than 10 percent of levels recorded before the conflict, leading operators to curtail regional production.

The Strait of Hormuz is a critical corridor for global energy, with an average of 20 million barrels per day transiting the waterway in 2025. This volume represents approximately 25 percent of the world's seaborne oil trade. Current disruptions have limited the options for bypassing the strait.

IEA members maintain stockpiles exceeding 1.2 billion barrels, in addition to 600 million barrels of industry stocks held under government mandates. The 400 million barrels release marks the sixth coordinated action in the agency's history since its formation in 1974. Previous releases occurred in 1991, 2005, 2011 and twice in 2022. The current export rate is estimated to be less than 10 percent of pre-conflict volumes.

Faith Birol, Executive Director, IEA, said, “The oil market challenges we are facing are unprecedented in scale, therefore I am very glad that IEA Member countries have responded with an emergency collective action of unprecedented size. Oil markets are global so the response to major disruptions needs to be global too. Energy security is the founding mandate of the IEA, and I am pleased that IEA Members are showing strong solidarity in taking decisive action together.”

Renault Doubles Down On India As A Strategic Export And Growth Hub

- By Nilesh Wadhwa

- March 10, 2026

As part of its evolving global roadmap, French automotive major Renault Group is increasingly aligning its strategy around a select set of high-growth markets, with India emerging as a critical pillar for the company’s future competitiveness.

Senior leadership indicated that the carmaker now views India not merely as a domestic sales market but as a full-fledged industrial and sourcing hub capable of strengthening its global supply chain. With localisation levels already exceeding 90 percent, the company believes the Indian ecosystem can play a significant role in improving cost competitiveness and supporting exports to other regions.

To accelerate this transformation, the Group strengthened its leadership structure in the India by appointing a Stephane Deblaise as its first Chief Executive Officer (CEO) to oversee the entire India operation. The move reflects a broader intent to deepen local decision-making and integrate the market more closely into Renault’s global strategy.

India and South America drive future trade opportunities

The company is also exploring the potential benefits of free trade agreements (FTAs) that could further strengthen export flows from India and South America.

Executives indicated that improved trade frameworks could enhance the role of India as a competitive production and sourcing base, particularly as global automakers reassess supply chains and regional manufacturing footprints.

At the same time, the company remains cautious in other global markets. Chinese suppliers currently account for around five percent of Renault’s global sourcing, and the group has no plans to re-enter the Chinese market in the near term.

A key shift in the group’s strategy since 2019 has been a move away from aggressively chasing volumes toward building stronger brand value and profitability.

Instead of pushing for market share in every region, Renault says it is focusing on markets where it can build a sustainable and profitable business case. The emphasis is now on delivering differentiated products, stronger customer value and improved quality rather than simply expanding volumes.

This philosophy is shaping the company’s approach to India as well.

Rather than targeting the entire market, Renault plans to focus on specific customer segments, particularly middle- and upper-income families seeking value-driven mobility solutions. The company believes that strengthening product positioning and improving residual values will ultimately support stronger brand perception.

India’s passenger vehicle market remains highly competitive, especially in the price band of EUR 15,000–20,000 vehicles, where global and domestic manufacturers are battling for share.

Historically, Renault established its presence in the country through entry-level offerings such as the Renault Kwid. However, the company is now looking to shift its brand positioning toward higher-value products.

The success of the Renault Duster in the past continues to shape Renault’s product roadmap, with the company describing the nameplate as a brand in itself in several markets. Building on this equity, Renault plans to introduce new SUV offerings that combine stronger design, advanced technologies and multi-energy powertrain options.

One such upcoming concept is the Renault Bridger, which the company believes could be a game changer in its product portfolio. Designed around flexible powertrain architectures, the model is expected to support multiple energy options as part of Renault’s broader global push toward electrified and hybrid mobility solutions.

The company emphasised that it is not starting from scratch in India, pointing out that millions of customers already drive Renault vehicles across the country.

Another major focus area for the group is accelerating product development cycles.

According to Renault’s leadership, one of the biggest challenges facing the global automotive industry today is the ability to develop new vehicles in less than two years while keeping pace with rapidly evolving technologies.

The company has already demonstrated faster development cycles in China and is now working to replicate that agility in Europe by integrating engineers and suppliers more closely into the product development process.

This approach could also influence Renault’s India strategy, particularly as the company looks to launch new products more quickly and respond faster to market shifts.

Strengthening downstream ecosystem

Beyond manufacturing and product strategy, Renault is also placing increasing emphasis on downstream value creation, including dealership networks, customer services and vehicle residual values.

Management believes that stronger engagement with dealers and improved lifecycle value for customers will be critical differentiators in markets like India, where brand perception and resale value play a significant role in purchasing decisions.

The company currently maintains capital expenditure and R&D spending below eight percent of revenue, while maintaining tight control over inventory levels, which average around EUR 1 billion globally.

While Renault acknowledges that its current market share in India remains modest, the company sees substantial long-term potential in the country’s rapidly expanding passenger vehicle market.

With a renewed focus on SUVs, high localisation levels and a shift toward value-driven products, the French automaker believes it has a credible opportunity to rebuild momentum in the market.

For Renault, the strategy is clear: rather than chasing scale at any cost, the company intends to grow selectively and profitably, with India playing an increasingly central role in its global ambitions.

Comments (0)

ADD COMMENT