Middle East Situation Likely To Strain Supply Chains

- By Bhushan Mhapralkar

- October 05, 2024

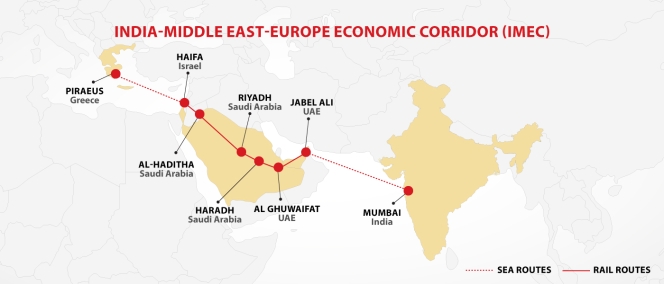

With the share market in India showing signs of being affected by the developments in the Middle East, it is quite likely that the supply chains, including those that influence the auto industry, will see some signs of strain eventually if not at once.

The likely reasons for this is the effect of an escalation in crude oil prices primarily. The others would involve shipping route disruptions such that the cargo ships carrying automotive parts, tools and equipment are unable to navigate their usual shipping lanes. This would result in delays and cost escalation as longer routes are chosen for safe passage. The example of Tesla and Volvo suspending manufacturing in early 2024 due to the conflict in the Red Sea is not yet lost.

In terms of trade and tariffs, the conflicts and tensions between countries can be detrimental. The cost for manufacturers using materials like steel and aluminum can escalate at a rapid pace.

With the Middle East known for its oil reserves, the current conflict and the way it is progressing is already having an effect on the crude prices. If it gets bad than this, large importing markets like India could see their crude import bills rise further. As it is, the prices of fossil fuels are already high with over 200 percent taxes.

Any disruption in oil supply will impart considerable volatility, transportation cost increase and strain on an economy that is already fighting post-Covid inflation.

Image for representative purpose only

- Qualcomm

- Tata Electronics

- OSAT

- Nakul Duggal

- Dr Randhir Thakur

- Savi Soin

- semiconductor

- SoC

- Snapdragon

Qualcomm And Tata Electronics To Manufacture Automotive Modules In India

- By MT Bureau

- February 20, 2026

Qualcomm Technologies and Tata Electronics have announced a partnership to manufacture Qualcomm Automotive Modules in India. Tata Electronics will join Qualcomm’s network of manufacturing partners to address demand for modular platforms in the automotive sector.

Production is scheduled to take place at Tata Electronics’ Outsourced Semiconductor Assembly and Test (OSAT) facility in Jagiroad, Assam. This facility, built with an investment of USD 3 billion, is the first indigenous site of its kind in India.

The collaboration focuses on the production of modules for digital cockpits, infotainment, connectivity and vehicle systems. Qualcomm Automotive Modules combine Snapdragon Digital Chassis system-on-chips (SoCs) with system components into a single unit. These modules are intended to simplify vehicle design and support the transition to software-defined vehicles.

The Assam facility will utilise several platform technologies, including:

- Wire Bond: For electrical connections between chips and leadframes.

- Flip Chip: To enable high-density connections for performance.

- Integrated Systems Packaging (ISP): For combining multiple components into a single package.

The partnership is intended to diversify the global semiconductor supply chain and support the ‘Make in India’ initiative. By establishing local manufacturing, the companies aim to provide automakers in India and international markets with greater supply chain flexibility.

Nakul Duggal, EVP and Group GM, Automotive, Industrial and Embedded IoT, and Robotics, Qualcomm Technologies, said, “Our work with Tata Electronics marks an important milestone in our automotive growth strategy. As the industry accelerates its shift toward integrated, module-based architectures, expanding manufacturing capacity in key regions becomes essential. Tata Electronics brings worldclass expertise, trusted production capabilities, and a shared commitment to strengthen India’s role in the global semiconductor and automotive ecosystems. Together, we will support automakers with scalable, high-performance solutions built in India.”

Dr Randhir Thakur, CEO & MD, Tata Electronics, added, “We are excited to partner with Qualcomm Technologies to manufacture their advanced automotive modules in India. This collaboration supports Tata Electronics’ objective to become a global hub for high‑technology manufacturing as a trusted partner to our leading semiconductor and automotive customers worldwide. We will leverage our Integrated Systems Packaging (ISP) solutions and deliver high quality, high-performance products to support Qualcomm Technologies’ global product leadership.”

Savi Soin, Senior Vice-President & President, Qualcomm India, added, “Modules are central to Qualcomm Technologies’ vision for the future of vehicle electronics. By providing comprehensive, ready-to-integrate solutions, we help automakers reduce design complexity and bring next-generation vehicles to market more quickly. Manufacturing in India through Tata Electronics enhances our ability to support both Indian and global OEMs with greater flexibility and supply chain resilience.”

Rockwell Automation Concludes 7th Edition Of India Inc On The Move Event

- By MT Bureau

- February 19, 2026

Rockwell Automation, Inc. has concluded the seventh edition of India Inc On The Move (IIOTM) in Mumbai. The event brought together industry leaders and technology innovators to discuss the impact of artificial intelligence (AI), digitalisation and sustainability on Indian manufacturing.

The conference, themed 'The Future Is Here: Smart. Sustainable. AI-Driven Manufacturing', addressed how technology can accelerate transitions in sectors including semiconductors, electronics, automotive, life sciences and food & beverage. These developments are intended to support the manufacturing sector’s role in the Viksit Bharat 2047 initiative.

IIOTM 2026 recorded over 1,200 attendees and included 30 sessions with 70 speakers. The event featured an expo floor with 30 booths displaying interactive technology solutions.

Key areas of discussion included:

- Autonomous Operations: Utilising AI to manage manufacturing processes.

- Software-Defined Manufacturing: Transitioning hardware control to software-based systems.

- Intelligent Sustainability: Implementing digitalisation to track and reduce environmental impact.

- Sector Focus: Strategies for semiconductors, life sciences and automotive industries.

Dilip Sawhney, Managing Director, Rockwell Automation India, said, “IIOTM stands as a catalyst for transformative thinking, bringing leaders together to envision how artificial intelligence can redefine modern manufacturing, unlock new possibilities at scale, and shape a resilient, sustainable industrial future for India.”

“India stands at a pivotal moment, where artificial intelligence, digitalisation and sustainability are converging to redefine industrial competitiveness. The next era of ‘smart’ manufacturing will be shaped by autonomous, software‑defined operations. For the industrial world, however, AI must rise to a higher purpose – being deterministic, explainable, and fully auditable,” added Sawhney.

Knorr-Bremse’s Begins Construction Of EUR 200 Million Chennai Future Campus

- By MT Bureau

- February 15, 2026

German component manufacturer Knorr-Bremse has initiated the construction of a modular campus in Chennai, India, with an investment plan of up to EUR 200 million over the next five years. The facility will integrate engineering, production and artificial intelligence (AI) activities.

Scheduled to commence operations in late 2027, the site will support both the Rail and Truck divisions. The campus is designed to accommodate up to 3,500 employees and will complement existing sites in Pune and Palwal.

The 188,000 square metre facility will be developed in phases. The initial stage includes production plants for metro and high-speed train entrance systems, alongside braking components for commercial vehicles. Later phases, extending to 2030, will add office complexes to house global business services, including finance and HR functions.

Products manufactured at the Chennai hub are intended for the Indian domestic market and global exports. Knorr-Bremse is currently a supplier for rail projects in Delhi and Chennai and is providing braking and sanitation systems for India’s high-speed rail network.

The company selected Chennai due to its infrastructure and engineering landscape. The new campus is located near the Knorr-Bremse AI centre established in 2025. This proximity is intended to accelerate digital projects and improve process efficiency.

Marc Llistosella, CEO, Knorr-Bremse, said, “India is a key region for us with great potential – as a location for innovation, a production hub, and a transport market. Our future campus enables us to connect global capabilities even more closely, make processes more efficient, and accelerate projects. This creates a strong foundation for our Rail and Truck divisions to grow profitably – in India as well as in international markets. The campus is an important building block in our global strategy and a clear commitment to Knorr-Bremse’s long-term growth path.”

- MIC Electronics Limited

- Letters of Acceptance (LoAs)

- Eastern Railway

- Howrah Division

- projects

- approximately

- INR 44.5 million.

MIC Electronics Secures Eastern Railway Orders

- By MT Bureau

- February 13, 2026

MIC Electronics Limited has secured Letters of Acceptance (LoAs) from Eastern Railway, Howrah Division, for projects valued at approximately INR 44.5 million.

The orders have been awarded under two separate competitive tenders and further strengthen the company’s position in India’s railway digital infrastructure ecosystem.

They involve design, supply, installation, testing, and commissioning of advanced Passenger Information and Communication Systems (PIS) across multiple railway stations in the Howrah Division. The scope of work includes the deployment of state-of-the-art railway information display systems and allied infrastructure, in line with Eastern Railway’s stringent technical, safety, and quality specifications. The projects are scheduled to be completed within six months from the date of issuance of the LoAs.

The development reinforces MIC Electronics’ strong execution capabilities in large-scale railway projects and its growing role in Indian Railways’ digital modernisation initiatives, said Rakshit Mathur, CEO, MIC Electronics Limited.

MIC Electronics specialises in the design, manufacture and implementation of Passenger Information Systems (PIS), railway display solutions, public address and communication systems, LED display and digital infrastructure solutions, and electronic and telecom infrastructure.

Comments (0)

ADD COMMENT