With the exciting range of autos being offered in the Indian market, the question that is being increasingly asked is about the pricing. Are Indian cars overpriced? Ravi Shankar from Chennai said that his plan to upgrade to a new car from his current stead – a 2013 model Volkswagen Polo GT TSI – threw some weird challenges. “The Hyundai Alcazar with a starting price of INR 1,700,000 and Skoda Kushaq with a starting price of INR 1,700,000 lakh look overpriced. Considering the fact that localisation has gained since I bought my Polo, the car prices should go down rather than go up. My Polo, with an imported TSI engine and a DSG transmission, cost INR 930,000 lakh. The Polo GT TSI on offer today is priced at INR 1,174,000 approximately in Chennai,” said Ravi. He added, “Should the price not go down rather than go up?” Mahesh Murthy from Bangalore said that he has postponed his plan to upgrade from his 2012 Punto. He finds the current car prices exorbitant.

A car dealer from Delhi expressed on the condition of not revealing his name that the interpretation or inference of a product being overpriced lies with the buyer. Cars today offer more creature comforts, safety and powertrain combinations, he said. This should justify their price, he added. Stating that a sub-four metre car costing close to or more than INR 1,500,000 is discomforting, Vikram Jagtap of Pune said that cars like these fit in a tax bracket that ensures a significant tax rebate. Asked if this was because of the regulations and features, he answered that the he is not certain if the addition of technologies and features like BS VI, airbags, ABS, ESP and EBD would lead to such a price escalation. Saikat from Kolkata averred cars like the Mahindra XUV300 and Tata Nexon offer among the best safety aspects if the preconception of buying a ‘big’ car at INR 1,500,000 is set aside. They offer a long list of safety features like seven airbags, ESP, ISOFIX seats, ABS, EBD, 5-Star GNCAP rating and more, he added.

Is it features?

Rohan Srivastava from Kanpur informed that the long list of features in today’s new cars is their differentiator as well as a catalyst for price increase. They, to an extent, justify the price increase. The other factors include inflation, which has in turn led to a jump in raw material prices, he added. Drawing attention to the near 40 percent jump in steel prices, which has affected his business, Srivastava said that some Indian car segments are reasonably priced. Srivastava drives a Hyundai. Neelkanth Sawant, a marketing professional from Pune, who drives a Maruti, said that car prices have kept pace with inflation. What failed to keep up with the pace are salaries in most jobs. “It is therefore that those looking to upgrade their cars seven-to-ten years down the line are finding it difficult to choose a new set of wheels costing 1.5 to two times more,” he added. Of the opinion that an INR 10,00,000 priced car of yesteryear lacked features like airbags, ABS, EBD, touchscreen, longer warranty coverage, parking sensors, auto wipers and head lamps, sun roof, climate control and connected car tech, an auto enthusiast from Hyderabad said that factor in inflation, and it is not illogical to have the current version of the same model cost INR 1,700,000.

Raveeraj from Bangalore averred manufacturers are pricing their autos as per the customer’s willingness to pay. The fact that most cars are well-equipped does not mean that they are overpriced, he added. Ajit Powar of Pune expressed cars in India tend to be overpriced than in many other markets of the world. They also tend to differ in quality, he quipped. Is it because laws concerning autos are perhaps not as strict as in the UK or the US? Powar could not provide a definitive answer. An industry observer stated that he has seen some companies practice a culture of using different materials in cars that they export. The grade of steel they use differs, the quality and thickness of paint they use differs and even the amount of insulation or features they offer is different, he said. This, he claimed, is done to address the stringent safety and other requirements of the export markets. In terms of emissions and safety, we lag behind the European and US markets, and yet the cars made in India are priced high. This has largely to do with the taxes and high cost of doing business, he explained. Ram Naresh of Hyderabad said that the TUV300 he bought in 2017 cost him INR 1,250,000 on road. On the top of it, he paid INR 250,000 as the loan interest. He spent around INR 50,000 on accessories. The total cost came to about INR 1,550,000. What he spent on diesel, service, spares, insurance etc. would amount to another INR 150,000 to INR two-lakh. Looking at upgrading to a new car, he is finding the prospect of spending INR 150,000 on a sub-four metre vehicle weird.

Inflation, weak Indian rupee, taxes, policies or greed?

Ram Naresh’s search of the low-end versions of cars has made him conclude that they are overpriced. “The Harrier XE, for example, is quite bare bone,” he said. “I have decided to postpone my decision to buy a new vehicle. I am now looking for a used car instead,” he added. Blaming inflation, weakening Indian rupee, the greed of automakers to make huge profits and the knee jerk reaction of authorities, Rohit from Indore said that it is high time cars are looked upon as a necessity and taxed accordingly. Bala from Chennai averred that tax policies have led to a great extent for cars to be highly overpriced. Electric cars are also not being spared, he rued. Look at the prices of electric cars and it does not look like the government is encouraging them, he quipped. Dev Tahalwani, who operates a three-wheeler, said that he finds the price of the new Mahindra Treo Zor electric three-wheeler high. And, if I avail finance, the cost is going further up, he complained. Expressing surprise over the recent EY survey report about buyers being ready to pay a premium of up to 20 percent, an industry source mentioned that the price of electric cars on offer in India is definitely high. The operating costs of such vehicles, their range, their reliability and their usability in terms of infrastructure are values that are yet not clear.

Checks and balances?

Of the opinion that law makers in US and Europe are far more aware and sensitive to the sentiments of buyers and the general public, an industry observer said that the situation in India has not matured as much. The level of checks and balances governing automakers in the US and Europe are simply not there, he added. Stating that inflation, depreciating Indian rupee, ever increasing taxes, availability of high tenure loans and stagnating incomes have already driven car prices to insane levels, Robin from Chennai mentioned that a good upgrade for a reasonable amount after four-to-five years is no longer in sight. Sanchit Chari from Bangalore said, “Taxes have remained the same for the last few years. When GST was rolled out, the rates were set to what the combination of pre-GST rates were (VAT, state taxes etc.). So, they are not the cause of price hikes. Their increase has been one-to-two percent, whereas the car prices have moved up by almost 30 to 50 percent during the same period.” “It needs to be investigated if the addition of safety and emission technologies as well as features would lead to an increase in prices to such a level,” he averred. Rajesh Tandel from Mumbai drew attention to the price escalation in some of the long running cars in India like the Toyota Innova. In 2005, the vehicle was launched at a starting price which was no more than INR seven lakh, he said. Today, he mentioned, the starting price of the same vehicle is no less than INR 1,600,000 lakh. An increase of INR eight-lakh for a product line that is not drastically different from that of 2005 is hard to grasp, he added.

A Delhi-based industry source expressed that the level of taxes on an automobile (there’s GST and a compensation cess of 48 percent, the enormous registration tax that is a state subject and continues to rise time and again), regulatory requirements and the cost of doing business are responsible for the costs rising so much and so often in at least the last one year. The average buying capacity of an Indian buyer has not risen in line, he informed. Explaining that INR 10,00,000 (roughly USD 13,000) is more or less the same amount of money incurred to develop a modern car – a compact SUV or a typical sedan – in comparison to other markets the world over, the source said that it is the tax component that needs to be looked at. Of the opinion that taxes would amount to a good portion of the prices paid to buy cars, Rohit remarked, “The increase in car prices is mainly due to base increases by manufacturers. Taxes are a percentage of base price and increase as the base price increases.” “If one wants to compare prices of cars with those that are also found in the US, he or she could compare the ex-showroom price there and the ex-showroom price here,” he explained. Doing the same some years ago, Rohit concluded that the base price of a car in India is a bit higher than in the US. This, despite the higher labour and regulatory cost in that country.

The demand for EVs worldwide is claimed to be at an all-time high. In 2020, EV sales surpassed three-million units as compared to the sale of 17,000 EVs globally in 2010. A clear message from these numbers is that the global auto industry is highly receptive to the idea of going electric. In India, the central government has announced the Phase II of the FAME policy. Various states have announced an EV policy. A consumer survey by EY has revealed that consumers are ready to pay a premium of up to 20 percent to buy an EV. For a price conscious Indian market, the prospect of paying a premium for an EV may sound a bit too far stretched. The survey conducted by the consultancy firm involved more than 9,000 respondents from 13 countries. Of these, 1,000 respondents were from India. Of the total respondents in the EY survey, 40 percent showed a willingness to pay a premium of up to 20 percent. Among the Indian respondents, three out of 10 people said they were open to buying an electric or hydrogen vehicle. Majority of the respondents from India expect a driving range of 100 to 200 miles (160 km to 321 km) from a fully charged electric vehicle, as per the report. Now the baffling part: the survey also gathered that nearly 90 percent of consumers in India are willing to pay a premium to buy an EV. Vinay Raghunath, EY India Partner and Automotive Sector Leader, said, "Consumers are willing to pay extra for an added value of being environmentally responsible." With 97 percent respondents stating that the Covid-19 pandemic has heightened awareness and concerns about environmental issues as the top reason to buy an EV, the EY survey has stated that they would also prefer to use digital channels to buy a car. Raghunath expressed, “The reducing gap in the cost of ownership between electric and other technology platforms and the increasing segment of consumers vocal about environmental impact will drive a fundamental change in consumer buying behaviour for EVs."

Mahindra Reports Consolidated PAT Of INR 46.75 Billion For Q3 FY2026

- By MT Bureau

- February 11, 2026

Mumbai-headquartered automotive major Mahindra & Mahindra (M&M) has announced its financial results for Q3 FY2026, reporting a consolidated Profit After Tax (PAT) of INR 46.75 billion, representing a 54 percent YoY growth.

The automotive division recorded quarterly volumes of 302,000 units, up 23 percent YoY. SUV revenue market share rose by 90 bps to 24.1 percent. The automotive business reported consolidated revenue of INR 303 billion, up 30 percent YoY, while PAT stood at INR 19.93 billion, up 42 percent YoY.

In the farm sector, tractor volumes reached 150,000 units, up 23 percent YoY, which translates to a market share of 44 percent for Q3. The revenue came at INR 115 billion, up 21 percent YoY, while PAT came at INR 10 billion, up 7 percent YoY.

Dr. Anish Shah, Group CEO & Managing Director, said, “We are delighted to report solid operating performance across the group in Q3’F26, reflecting our strong focus on growth coupled with disciplined execution. Auto & Farm has maintained its leadership position on the back of steady customer demand, strong product acceptance and unwavering focus on operational excellence. TechM continues to make meaningful progress. Mahindra Finance delivered another solid quarter with meaningful PAT growth while maintaining strong asset quality. We are especially pleased to see breakout performance from two of our growth gems, Mahindra Logistics and Mahindra Lifespaces.”

Rajesh Jejurikar, Executive Director & CEO (Auto and Farm Sector), said, “Auto and Farm businesses delivered strong performance in Q3’FY26. We have achieved a 90 bps YoY increase in SUV revenue share and 10 bps YoY increase in LCV (< 3.5T) market share in Q3. Our tractor business gained 20 bps YoY to reach an impressive 44.1 percent share for YTD FY26. Our new launches XEV 9S, and the XUV 7XO have received very positive response in the market.”

Amarjyoti Barua, Group Chief Financial Officer, added. “Our Q3 consolidated results reflects the strength and depth of our diversified portfolio. Our services businesses continue to increase their contribution to the overall results. Our results are also translating into a very strong Balance Sheet.”

- CEER

- Saudi Arabia

- Abdul Latif Jameel

- Zamil Trade & Services

- Zamil Plastics

- NSSPC

- KK Nag

- Mino

- FEV

- AVL

- MK Tron

- XYG

- Sika

- AITS

- FPI

- James DeLuca

CEER Inks 16 Agreements Worth USD 996 Million To Expand Saudi EV Supply Chain

- By MT Bureau

- February 10, 2026

CEER, Saudi Arabia’s first electric vehicle (EV) brand and Original Equipment Manufacturer (OEM), has signed 16 commercial agreements valued at over SAR 3.7 billion (USD 996.90 million). The deals were announced at the 4th PIF Private Sector Forum, following SAR 5.5 billion (USD 1.4 billion) in agreements secured at the previous year's event.

The partnerships are part of a localisation strategy that aims to source 45 percent of vehicle materials and components from Saudi companies by 2034. The supply chain will support CEER’s production plan of seven models over the next five years.

The agreements cover a range of essential automotive components and services:

- Fluids and Plastics: Abdul Latif Jameel (ALJ) will supply windshield washer fluid and EV coolants. Zamil Trade & Services and Zamil Plastics will provide brake fluids and aerodynamic covers.

- Materials and Polymers: NSSPC is contracted for PP resin and polymer compounds, while KK Nag will provide Expanded Polypropylene (EPP).

- Engineering and Infrastructure: Mino will install steel Body Shop equipment. FEV and AVL will provide engineering services.

- Manufacturing: MK Tron will produce small stampings, window regulators, and door hinges. FPI will supply front-end modules and XYG will provide glazing solutions.

- Chemicals and HVAC: Sika is contracted for structural adhesives and cavity baffles, while AITS will work on HVAC localisation.

The project is expected to contribute SAR 30 billion (USD 8 billion) to Saudi GDP by 2034 and improve the trade balance by SAR 79 billion (USD 21 billion). CEER estimates the creation of 30,000 direct and indirect jobs, aligning with the industrial diversification goals of Saudi Vision 2030.

James DeLuca, CEO, CEER, said, “These agreements are a cornerstone of CEER's wide and deep localisation strategy, which targets sourcing 45 percent of vehicle materials and components from Saudi companies by 2034. Our approach goes beyond mere assembly, we are utilising local raw materials and empowering Saudi companies to become global suppliers, directly contributing to Vision 2030’s mission to diversify the national automotive industry and drive sustainable economic growth.”

“These agreements represent a major step in building a comprehensive automotive ecosystem in the Kingdom. By using local materials and resources, attracting advanced technology and foreign investment, and localising the production of heavy and labour-intensive components, we aim to reduce CO2 emissions and create meaningful job opportunities for Saudi nationals,” added DeLuca.

Cars24 Introduces Refreshed Brand Identity

- By MT Bureau

- February 09, 2026

Cars24 has unveiled a refreshed brand identity, moving from its original transactional focus towards a car ownership ecosystem.

Founded in 2015, the company originally utilised an all-caps logo – CARS24 – to establish a presence in a fragmented market. The updated identity shifts the name to sentence case, Cars24, which the company states reflects maturity and a focus on trust.

The core of the redesign features an open circular logo. According to the company, this form represents the continuity of car ownership, where vehicles change hands and user needs evolve. The open shape is intended to signal flexibility rather than closure.

The brand has also replaced its traditional blue with a brighter shade. This ‘younger blue’ is intended to make the brand appear more attentive and human as it scales its operations.

The identity update was the result of over 1,200 hours of design and iteration. The goal of the project was to create a look that remains relevant as the company expands its services beyond buying and selling into broader ownership systems.

Vikram Chopra, Founder & CEO, Cars24, said, “When we started, being loud helped. But as the company and the team grew up, the work started speaking for itself. This change is about reflecting who we are today, calmer, more human and focused on earning trust over time.”

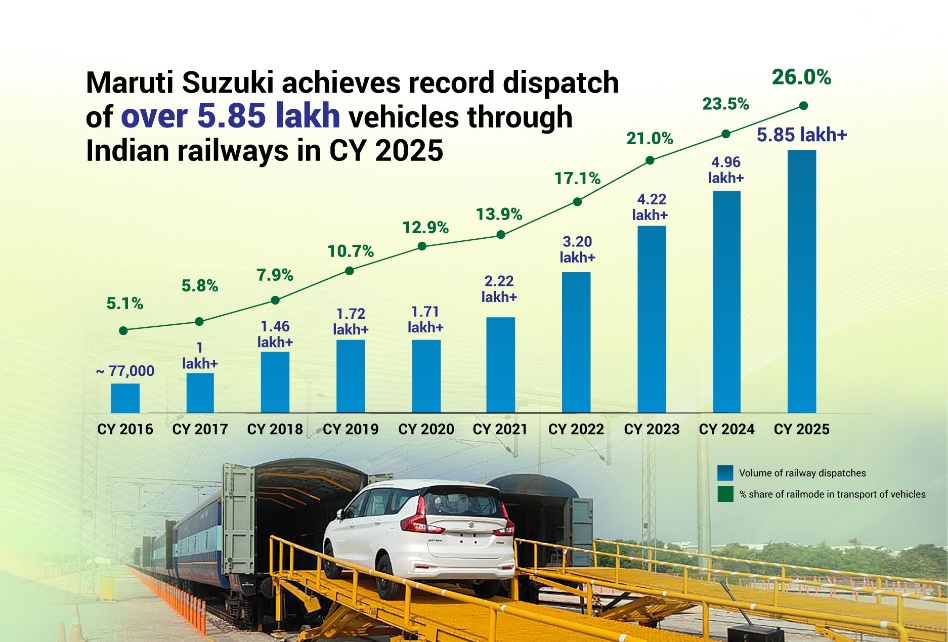

Maruti Suzuki India Increases Rail Dispatches To 585,000 Units, Up 18% In 2025

- By MT Bureau

- February 09, 2026

Maruti Suzuki India, the country’s largest passenger vehicle manufacturer, has reported the dispatch of over 585,000 vehicles using the railway network in CY2025, which marked an 18 percent growth compared to CY2024.

Over the last decade, the company's use of rail for outbound logistics has risen from 5.1 percent in 2016 to approximately 26 percent in 2025. The shift aims to reduce carbon emissions, oil imports and road congestion.

In 2025, Maruti Suzuki India inaugurated an in-plant railway siding at its Manesar facility. The company also became the first manufacturer to dispatch vehicles to the Kashmir valley using the railway bridge over the Chenab river.

Combined dispatches from in-plant sidings at Gujarat and Manesar accounted for 53 percent of the company's total rail volumes during the year. The manufacturer currently employs 45 flexi-deck rakes, with each train capable of transporting approximately 260 vehicles.

Combined dispatches from in-plant sidings at Gujarat and Manesar accounted for 53 percent of the company's total rail volumes during the year. The manufacturer currently employs 45 flexi-deck rakes, with each train capable of transporting approximately 260 vehicles.

The company was the first automaker to receive an Automobile-Freight-Train-Operator (AFTO) license in 2013. Since FY2014-15, it has transported more than 2.8 million vehicles to 600 cities using a hub-and-spoke model.

Hisashi Takeuchi, MD & CEO, Maruti Suzuki India, said, “The year 2025 marks our highest-ever rail dispatch, with over 585,000 units. During the year, we strengthened our green logistic efforts through two landmark events – the inauguration of India’s largest automobile in-plant railway siding at our Manesar facility and second was we dispatched vehicles by rail to Kashmir valley through the world's highest railway arch bridge over Chenab river, a first by any automobile manufacturer. Our mid-term goal is to increase rail-based vehicle dispatches to 35 percent by FY 2030-31, contributing to India’s net-zero ambition by 2070. Maruti Suzuki India has adopted a comprehensive ‘Circular Mobility’ approach to sustainability, aiming to reduce its carbon footprint across the entire vehicle lifecycle – from design and production to logistics and end-of-life vehicle (ELV) management.”

Comments (0)

ADD COMMENT