Tata Motors Reports INR 33.43 Billion Net Profit For Q2 FY2025

- By MT Bureau

- November 08, 2024

Tata Motors, one of the leading passenger and commercial vehicles manufacturer, has announced its financial results for Q2 FY2025.

The company reported consolidated revenue of INR 1,015 billion, down 3.5 percent YoY; EBITDA at 1,160 billion, down 230 bps and net profit at INR 33.43 billion, down 11 percent YoY.

During the quarter, the passenger vehicle volumes were down 6.1 percent YoY at 130,500 units on the back of slow consumer demand and seasonal factors. The commercial vehicle sales came at 79,800 units, lower 19.6 percent YoY impacted by slowdown in infrastructure project execution, reduction in mining activity and an overall drop in fleet utilisation due to heavy rains.

On the other hand, Jaguar Land Rover delivered an eighth successive profitable quarter, despite temporary aluminium supply constraints.

Going forward, the company has maintained a cautious outlook for the near-term in domestic demand. However, the festive season and substantial investments in infrastructure should help bolster it. JLR wholesales are expected to improve sharply, as supply challenges ease. Overall, we expect an all-round improvement in performance in H2 FY25 and the business to become net debt free by this year.

PB Balaji, Group CFO, Tata Motors, said: “Growth in the quarter was impacted due to significant external challenges as highlighted earlier. Overall, the business fundamentals remain strong, and we remain focused on our agenda of driving growth, competitiveness and free cash flows. As the supply challenges ease and demand picks up, we are confident of steady improvement in our performance and delivering a strong H2.”

Shailesh Chandra, MD, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, said: “The passenger vehicle industry in Q2 FY25 witnessed around 5 percent decline in registrations, resulting in continued build-up of channel inventory. Sales of EVs were additionally impacted by lapse of certain subsidies. We moderated our offtakes in Q2 to proactively keep our channel inventory under control. Q3 has started off with a resurgence in industry demand on the back of a robust festive season. Tata Motors recorded its highest ever monthly registrations of around 68.5k during October, which helped in bringing down the inventory to normal levels. Our multi-powertrain suite of Curvv, Nexon iCNG and Nexon.ev 45 has garnered strong consumer interest as we continue to ramp up deliveries in Q3.”

Girish Wagh, Executive Director, Tata Motors, said, “Q2 FY25 moderated the positive momentum seen by the commercial vehicles industry at the start of the fiscal, due to slowdown in infrastructure project execution, reduction in mining activity and an overall drop in fleet utilization due to heavy rains. Tata Motors Commercial Vehicles domestic sales at 79.8K units were 19.6 percent lower than Q2 FY24 sales. Our demand-pull strategy and vigilance on costs had the business deliver EBITDA margins of 11.2 percent in H1 FY25. Going forward, with the rains easing, increased infrastructure spending, and the arrival of the festive season boosting consumption, we anticipate demand to pick up.”

Adrian Mardell, Chief Executive Officer, JLR, said: “JLR has delivered a resilient performance in Q2, resulting in a 25 percent increase in first half profits year-on-year. Our teams responded brilliantly to the aluminium supply shortages we experienced in the quarter, so we could deliver as many orders as possible to clients. We continue to make good progress delivering our Reimagine strategy. We have invested GBP 250 million so far to prepare our Halewood UK plant for electric vehicle production and with strong global demand for our products, we are well positioned to deliver on our commitments again this financial year.”

Mahindra Reopens Bookings For BE 6 Batman Edition SUV

- By MT Bureau

- March 06, 2026

Mumbai-headquartered automotive major Mahindra & Mahindra has announced the return of the BE 6 Batman Edition, a themed electric SUV developed in association with Warner Bros. Discovery Global Consumer Products. The decision to reopen bookings follows the initial launch, where 999 units were sold in 135 seconds.

The EV available at INR 2.84 million is based on the top-end Pack Three 79 kWh variant of the BE 6. This second release provides a window for customers who missed the previous allocation. Priority for deliveries will be granted to new bookings referred by existing owners of the original 999 units.

The BE 6 Batman Edition incorporates design motifs from Christopher Nolan’s The Dark Knight Trilogy. The exterior features a satin black colour with alchemy gold accents on the suspension and brake callipers. It sits on R20 alloy wheels.

External features include:

- Badging: BE 6 × The Dark Knight rear badging and signature stickers on door cladding.

- Emblems: The Bat emblem is placed on hub caps, quarter panels, bumpers, and windows.

- Lighting: Carpet lamps projecting the Bat emblem.

- Roof: An Infinity Roof featuring trilogy-inspired graphics.

On the inside, it gets a brushed alchemy gold Batman Edition plaque and pinstripe graphics on the dashboard. Suede and leather seating with gold sepia stitching and embossed emblems upholstery. Emblems on the ‘Boost’ button and custom detailing on the steering wheel and key fob. A digital themed welcome animation on the infotainment system and custom exterior engine sounds.

For customers interested in purchasing the limited-edition model, Mahindra has outlined the specific schedule for the procurement process:

- 6 March 2026: "Add Your Preference" window opens on the official website.

- 10 March 2026: Bookings commence at 11:00 AM for a 24-hour period.

- 10 April 2026: Commencement of vehicle deliveries.

Mahindra stated that the reopening of bookings is a response to demand across social media platforms. The technical architecture remains identical to the high-performance BE 6 electric platform, utilising the 79 kWh battery system for range and power delivery.

- Kia India

- Buckle Up

- MoRTH

- Ajay Tamta

- The Social Lab Foundation

- TSL

- Road Safety

- Atul Sood

- Apoorva Sharma

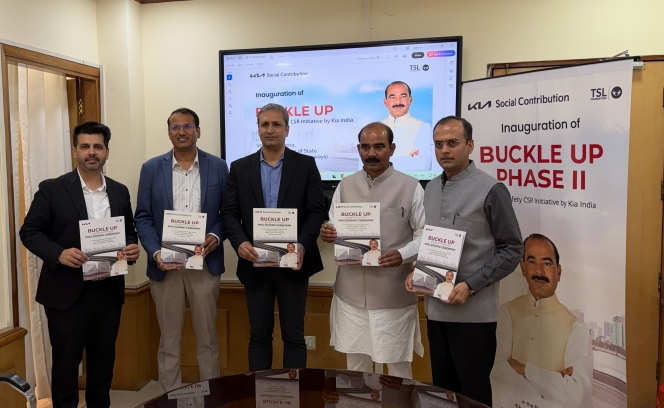

Kia India Launches Phase II Of Buckle Up Road Safety Programme

- By MT Bureau

- March 06, 2026

Kia India, one of the leading passenger vehicle manufacturers, has announced the commencement of Phase II of its ‘Buckle Up’ road safety initiative. The project is conducted in partnership with The Social Lab Foundation (TSL) and is supported by the Ministry of Road Transport and Highways (MoRTH).

The second phase was inaugurated by Ajay Tamta, Minister of State for Road Transport and Highways, at Transport Bhawan. As part of the launch, Kia India and TSL signed a Memorandum of Understanding (MoU) to expand the programme’s geographic reach into Delhi-NCR and Uttarakhand over the next two years.

Phase I, which ran from February 2024 to February 2026, focused on Gurugram in collaboration with local traffic police. Key outcomes included the installation of 750 crash barriers at high-risk locations and road safety education for 32,000 students across 100 schools.

Phase II (April 2026 – March 2028) shifts focus toward older students and expanded infrastructure. The programme aims to engage 20,000 students across 100 colleges using driving simulators and experiential modules to demonstrate real-world risks.

The initiative combines physical safety installations with behavioural training. Future infrastructure work includes placing additional crash barriers along the Delhi-Uttarakhand highway and in Gurgaon.

Key programme components for Phase II include:

- Simulated Training: Use of advanced driving simulators to teach safer driving behaviours to college students.

- Infrastructure Upgrades: Continued installation of safety barriers in high-risk zones.

- Awareness Campaigns: Integrated on-ground and digital engagement programmes.

- Geographic Expansion: Operations extending across Delhi-NCR and Uttarakhand.

Ajay Tamta, said, “Securing CMVR Type Approval for the Urbanova KE9 is a defining milestone for Keto Motors. This certification reinforces our commitment to delivering dependable, high-performance electric mobility solutions designed specifically for Indian roads and fleet operators. With approvals in place, we are now focused on accelerating customer deployments and supporting India’s transition toward clean, zero-emission public transport.”

Atul Sood, Senior Vice-President – Sales & Marketing, Kia India, said, “At Kia India, safety is a fundamental pillar of our mobility vision, extending beyond our vehicles to the communities we serve. ‘Buckle Up’ reflects our long-term commitment to creating safer mobility ecosystems through infrastructure enhancement and sustained behavioural change initiatives. With Phase II, we are scaling our efforts to reach young and first-time drivers while strengthening on-ground safety interventions. Through this initiative, we are proud to support the Government of India’s vision of safer roads and contribute meaningfully towards building a stronger culture of road safety across communities.”

Apoorva Sharma, Executive Director, TSL Foundation, added, “Our collaboration with Kia India in Phase I laid a strong operational foundation through targeted infrastructure and school-level engagement. With Phase II, we are building on these learnings to scale the programme across new geographies and age groups, further strengthening its impact through structured, experiential road safety interventions.”

Zenvo Automotive Appoints Mark Harrison As Chief Commercial Officer

- By MT Bureau

- March 05, 2026

Zenvo Automotive, a manufacturer of limited-edition hypercars based in Præstø, Denmark, has appointed Mark Harrison as its new Chief Commercial Officer, bringing in a seasoned expert from the premium and performance car sector. His arrival marks a significant step in the company’s ambitious growth strategy as it prepares for the final development phase of its highly anticipated V12 Aurora hypercar. Harrison will oversee all commercial operations, including sales, marketing, public relations, global events and the expansion of the dealer network, working closely with the established leadership team comprising Chairman Jens Sverdrup, Chief Technical Officer Jon Gunner and Design Director Christian Brandt.

With three decades of industry experience, Harrison joins Zenvo from Praga Cars, having previously held influential management roles at McLaren Automotive and BMW Group, including its MINI division. His comprehensive understanding of the luxury automotive landscape is expected to be instrumental as the company moves towards the Aurora’s launch. Harrison’s appointment reinforces the management structure during this critical period, ensuring the commercial strategy aligns with the final engineering and design efforts to bring the new hypercar to market.

Jens Sverdrup, Chairman, Zenvo Automotive, said, “It is great to welcome Mark to the team, and to benefit from his experience and insight of the industry. We have known each other for many years, and our professional paths have crossed on several occasions, so I know first-hand what an impact he will be able to make. We are at an exciting part of the programme, and this appointment also highlights, once again, the talent that this project is attracting as we gear up for the launch of Aurora.”

Harrison said, “It’s really exciting to join Zenvo’s team and help bring to market a truly exceptional car in both its design and technical specification. I have admired the brand since the Aurora was announced and especially how the programme is pushing the boundaries in such a competitive sector. I have shared offices, showrooms, show stands and factories with great teams wherever I have worked, but this will be my first V12. I feel privileged to now have an opportunity to work together with this strong and passionate team helping bring this stunning car to market later this year.”

Renault Reveals The Name Of Its Upcoming Show-Car: Bridger Concept

- By MT Bureau

- March 04, 2026

Renault has unveiled the name of its latest show-car, the Bridger Concept, as part of its continued international expansion. This model serves as a precursor to a forthcoming production vehicle, specifically an urban SUV designed with new dimensions to accommodate the evolving needs of city-dwelling families.

The Bridger Concept stands out with its bold and robust design, featuring surprisingly compact proportions. Measuring under four metres in length, it maximises interior space, demonstrating that a smaller footprint does not necessitate a compromise on roominess. The name itself, derived from the English word ‘bridge’, was chosen for its connotations of strength, connection and linkage. This choice highlights the vehicle's assertive styling and reinforces the brand's commitment to fostering human connections within the cabin, a core aspect of its ‘voitures à vivre’ philosophy.

A comprehensive reveal of the Bridger Concept is scheduled for 10 March 2026. This unveiling will occur during the presentation of Renault Group's futuREady strategic plan, with the entire event being streamed live from the company's official events platform.

Explaining the thinking behind the name of the new show-car, Sylvia dos Santos, Head of Naming Strategy with Renault's Global Marketing Division, said, “With Renault Bridger, we are adding to our family of names based on English words. This one comes from the word 'bridge', with the letters 'ER' added for identification. The name Renault Bridger is part of the same approach as the name of Renault Duster. It’s a powerful, robust and versatile name, ideal to identify our new urban SUV show-car and open a new page in our international offensive!”

Comments (0)

ADD COMMENT