Trends: Executive Sedans

- By Venkatesh P Koushik

- August 12, 2021

The year was 2000. The first two Completely Built Units (CBU) of Skoda Octavia landed in India and rushed to Aurangabad where the Volkswagen Group company would eventually set up a modern manufacturing facility. A confident Imran Hassan, as the head of the Czech company in India, looked keen to drill the fact that his Octavia was a car with a Czech badge but actually German in its quality – build and almost all of that it had to offer. A precursor of a segment that would pull buyers big time, the Octavia was official launched a year later in 2001. It was the same year that the Honda Accord was launched, albeit at a higher price point. The Hyundai Sonata too hit the market soon. The Honda Civic arrived in 2005, whereas the Toyota Corolla in 2003. The Hyundai Elantra arrived at round the same time. With SUVs yet to be the rage, these aspirational ‘executive’ sedans soon defined a new standard in the Indian auto industry. They came to occupy what would be termed as the C+ or D-segment. Forming an upper crest of sedans that were status and lifestyle-oriented, the two segment cars drew large sales volumes. The Octavia sold an estimated 8,000 units in 2005. A year before, in 2004, Honda Siel Cars sold 2,977 Accords. It cornered an enviable market share of 40 percent in its segment, an increase of 69 percent over 2003.

Between 2001 and 2010, the ‘executive’ sedan segment continued to be the ‘force’ with good sales. The introduction of new models like the Toyota Corolla and Honda Civic helped. The launch of large SUVs like the Hyundai Terracan, Ford Endeavour and Honda CR-V in the same time span did not create much ruffle as these were priced higher and were out of reach of many. It was with the launch of the Toyota Fortuner in 2009 that the SUV segment began gaining some serious muscle. By then, the D-segment had seen a good amount of shake and tumble. New additions included the Volkswagen Jetta and Passat. By 2011, the segment comprised the Toyota Corolla, Skoda Octavia, Honda Civic, Volkswagen Jetta, Hyundai Sonata Embera, Chevrolet Cruze and a few others. Crowded it became, and with an amount of fanfare to boast of. It turned out to be a segment that every manufacturer wanted a pie of. This, despite the SUV rage catching on since 2012 as the Ford EcoSport and Renault Duster arrived on the scene.

Between 2001 and 2010, the ‘executive’ sedan segment continued to be the ‘force’ with good sales. The introduction of new models like the Toyota Corolla and Honda Civic helped. The launch of large SUVs like the Hyundai Terracan, Ford Endeavour and Honda CR-V in the same time span did not create much ruffle as these were priced higher and were out of reach of many. It was with the launch of the Toyota Fortuner in 2009 that the SUV segment began gaining some serious muscle. By then, the D-segment had seen a good amount of shake and tumble. New additions included the Volkswagen Jetta and Passat. By 2011, the segment comprised the Toyota Corolla, Skoda Octavia, Honda Civic, Volkswagen Jetta, Hyundai Sonata Embera, Chevrolet Cruze and a few others. Crowded it became, and with an amount of fanfare to boast of. It turned out to be a segment that every manufacturer wanted a pie of. This, despite the SUV rage catching on since 2012 as the Ford EcoSport and Renault Duster arrived on the scene.

Vehicle buyers in India were suddenly exposed to a wider scheme of things; they were in fact torn between choosing an aspirational sedan or an SUV. The D-segment cars soldiered on with fair numbers to talk home about, albeit the likes of Civic and Octavia and not the Accord and the Sonata. On muted sales volumes, Honda discontinued the Accord in 2013. In May 2013, only 24 units of the ‘executive’ sedan were sold as compared to the sale of 68 CR-Vs. The Toyota Corolla sold 368 units in May 2013 as compared to the sale of 353 numbers in the month before. The Volkswagen Jetta sold 266 numbers in May 2013, and the Passat, 141 numbers. The Octavia, renamed as the Laura, sold 305 units in May 2013 as compared to the sale of 126 units in April 2013.

The near six-car D-segment has shrunk to a lone warrior in 2021. With the latest generation Honda Civic launched and quietly discontinued, the only car that seems to make up the segment today is the new Skoda Octavia. In the absence of Toyota Corolla, the only other car in the segment to give company to the Octavia is the Hyundai Elantra. Its numbers are anything to write home about today. The new Octavia has been priced uncomfortably close to the Superb with a starting price of INR 26 lakh. When it was first introduced in 2001, it was priced at no more than INR 10 lakh.

The near six-car D-segment has shrunk to a lone warrior in 2021. With the latest generation Honda Civic launched and quietly discontinued, the only car that seems to make up the segment today is the new Skoda Octavia. In the absence of Toyota Corolla, the only other car in the segment to give company to the Octavia is the Hyundai Elantra. Its numbers are anything to write home about today. The new Octavia has been priced uncomfortably close to the Superb with a starting price of INR 26 lakh. When it was first introduced in 2001, it was priced at no more than INR 10 lakh.

The executive sedan dilemma

If the Renault Duster should be credited to create some serious pull towards SUVs in India starting from 2012, today, it is the segments containing SUVs that are the most crowded. The clues of how the D-segment has shrunk to include just the Elantra or the Octavia (the new Octavia actually looks to have moved up and beyond the reach of this segment ironically) may be found in the proliferation of the SUVs at various levels – right from the Ford EcoSport level to the Toyota Fortuner level (where SUVs assume a serious form and function, complete with a 4WD system). A segment that did an estimated 10,000 units in 2005 has come down to a few hundred units in 2021. In January 2021, 32 units of the Elantra were sold. Eight units of the Octavia were sold. The Superb sold 239 units in the same month! Comprising cars that measure over 4.5m in length and are powered by engines with a displacement capacity of between 1800 cc and 2000 cc, the D-segment contenders have been priced between INR 15 lakh and INR 25 lakh.

If the Renault Duster should be credited to create some serious pull towards SUVs in India starting from 2012, today, it is the segments containing SUVs that are the most crowded. The clues of how the D-segment has shrunk to include just the Elantra or the Octavia (the new Octavia actually looks to have moved up and beyond the reach of this segment ironically) may be found in the proliferation of the SUVs at various levels – right from the Ford EcoSport level to the Toyota Fortuner level (where SUVs assume a serious form and function, complete with a 4WD system). A segment that did an estimated 10,000 units in 2005 has come down to a few hundred units in 2021. In January 2021, 32 units of the Elantra were sold. Eight units of the Octavia were sold. The Superb sold 239 units in the same month! Comprising cars that measure over 4.5m in length and are powered by engines with a displacement capacity of between 1800 cc and 2000 cc, the D-segment contenders have been priced between INR 15 lakh and INR 25 lakh.

Sitting above the C-segment, which consists of cars like the Maruti Ciaz and the Hyundai Verna, the D-segment cars have always been about status, comfort, features and performance. They are therefore about lower sales volumes and high production costs, making them difficult to pursue by many automakers. Proving to be a segment that has been tough to crack for many OEMs, the ones to taste immense success have been Skoda and Toyota with their Octavia and Corolla, respectively. With sales shrinking to become a fraction of that of the SUVs, and even not being as strong during their peak, the D-segment is a study that should reveal the time travel of the Indian passenger vehicle space. Affected extensively by the proliferation of SUVs at various price points, the D-segment is all but gone. The recent figures by SIAM indicating that SUV acceptance has increased steadily, and has grown to be more than the total sales of sedans and hatchbacks combined in the April-June quarter of 2021, the D-segment, it is clear, has shrunk drastically. With the B-SUVs (like Maruti Suzuki Brezza, Hyundai Venue, Tata Nexon) eating into the C-sedan segment and the larger C-SUVs (like KIA Seltos, Tata Harrier, Hyundai Creta) taking a pie out of the D-sedan segment, what was once considered as the most coveted has now been relegated to soldier on with much difficulty.

Sitting above the C-segment, which consists of cars like the Maruti Ciaz and the Hyundai Verna, the D-segment cars have always been about status, comfort, features and performance. They are therefore about lower sales volumes and high production costs, making them difficult to pursue by many automakers. Proving to be a segment that has been tough to crack for many OEMs, the ones to taste immense success have been Skoda and Toyota with their Octavia and Corolla, respectively. With sales shrinking to become a fraction of that of the SUVs, and even not being as strong during their peak, the D-segment is a study that should reveal the time travel of the Indian passenger vehicle space. Affected extensively by the proliferation of SUVs at various price points, the D-segment is all but gone. The recent figures by SIAM indicating that SUV acceptance has increased steadily, and has grown to be more than the total sales of sedans and hatchbacks combined in the April-June quarter of 2021, the D-segment, it is clear, has shrunk drastically. With the B-SUVs (like Maruti Suzuki Brezza, Hyundai Venue, Tata Nexon) eating into the C-sedan segment and the larger C-SUVs (like KIA Seltos, Tata Harrier, Hyundai Creta) taking a pie out of the D-sedan segment, what was once considered as the most coveted has now been relegated to soldier on with much difficulty.

With India refusing to shift from being a price sensitive market, and with a certain purchasing power equation always present, the growth in SUVs that come at desirable price points with an aspirational value to talk about, the D-segment, it may be an exaggeration to say is on its last legs. Undercutting sedans when it comes to pricing, SUVs are proving to be the ruthless D-segment killers. Presenting a strong perception regarding ‘value for money’, it is they that are providing no chance for even the existing D-segment contenders to have much leeway. They may be world-class and highly regarded the world over, but the D-segment cars like the Skoda Octavia and Hyundai Elantra look like they are up against a wall. Made from Completely Knocked Down (CKD) kits that are weighed by the cost versus volume considerations, the D-segment cars that exist suffer from a significant cost disadvantage. Add low demand, and it is not surprising for Skoda to position the new Octavia within rubbing distance of the Superb in terms of price and features. Such is it that those looking for ventilated seats could go for the Superb and those not needing them could for the Octavia!

With India refusing to shift from being a price sensitive market, and with a certain purchasing power equation always present, the growth in SUVs that come at desirable price points with an aspirational value to talk about, the D-segment, it may be an exaggeration to say is on its last legs. Undercutting sedans when it comes to pricing, SUVs are proving to be the ruthless D-segment killers. Presenting a strong perception regarding ‘value for money’, it is they that are providing no chance for even the existing D-segment contenders to have much leeway. They may be world-class and highly regarded the world over, but the D-segment cars like the Skoda Octavia and Hyundai Elantra look like they are up against a wall. Made from Completely Knocked Down (CKD) kits that are weighed by the cost versus volume considerations, the D-segment cars that exist suffer from a significant cost disadvantage. Add low demand, and it is not surprising for Skoda to position the new Octavia within rubbing distance of the Superb in terms of price and features. Such is it that those looking for ventilated seats could go for the Superb and those not needing them could for the Octavia!

With such fine differentiation defining the current crop of vehicles that make up the D-segment, a big shake down does not seem far away. It could be driven by regulations and market requirements for certain. Already dissuading many OEMs to drop their D-segment offering, regulations like BS VI have indeed been a big factor. The other has been the availability of SUVs at price points that correspond with D-segment sedans. A big plus concerning SUVs is the status and lifestyle image they present. The other is their ability to travel over rough terrain and provide good visibility due to the high seating position. Providing a sense of invincibility, SUVs seem to offer more than a D-segment sedan could, today. At the top, it has increasingly come under pressure from luxury sedans and other offerings from brands like Audi, Mercedes-Benz and BMW. Some of the entry-level products from these OEMs don’t cost a premium. Owning used luxury cars has also become easy as their volumes have risen. This too has put pressure on the existence of the D-segment without any doubt. W ith the Octavia taking a position within close proximity to the Superb, the future of D-segment, at best, looks tough. This, even with the talk of the new Elantra being introduced gaining force with every passing day. Unless Hyundai unleashes the Elantra with some novel trick up its sleeve, there’s not much left to talk about the once glorious D-segment. (MT)

Mahindra Reports Consolidated PAT Of INR 46.75 Billion For Q3 FY2026

- By MT Bureau

- February 11, 2026

Mumbai-headquartered automotive major Mahindra & Mahindra (M&M) has announced its financial results for Q3 FY2026, reporting a consolidated Profit After Tax (PAT) of INR 46.75 billion, representing a 54 percent YoY growth.

The automotive division recorded quarterly volumes of 302,000 units, up 23 percent YoY. SUV revenue market share rose by 90 bps to 24.1 percent. The automotive business reported consolidated revenue of INR 303 billion, up 30 percent YoY, while PAT stood at INR 19.93 billion, up 42 percent YoY.

In the farm sector, tractor volumes reached 150,000 units, up 23 percent YoY, which translates to a market share of 44 percent for Q3. The revenue came at INR 115 billion, up 21 percent YoY, while PAT came at INR 10 billion, up 7 percent YoY.

Dr. Anish Shah, Group CEO & Managing Director, said, “We are delighted to report solid operating performance across the group in Q3’F26, reflecting our strong focus on growth coupled with disciplined execution. Auto & Farm has maintained its leadership position on the back of steady customer demand, strong product acceptance and unwavering focus on operational excellence. TechM continues to make meaningful progress. Mahindra Finance delivered another solid quarter with meaningful PAT growth while maintaining strong asset quality. We are especially pleased to see breakout performance from two of our growth gems, Mahindra Logistics and Mahindra Lifespaces.”

Rajesh Jejurikar, Executive Director & CEO (Auto and Farm Sector), said, “Auto and Farm businesses delivered strong performance in Q3’FY26. We have achieved a 90 bps YoY increase in SUV revenue share and 10 bps YoY increase in LCV (< 3.5T) market share in Q3. Our tractor business gained 20 bps YoY to reach an impressive 44.1 percent share for YTD FY26. Our new launches XEV 9S, and the XUV 7XO have received very positive response in the market.”

Amarjyoti Barua, Group Chief Financial Officer, added. “Our Q3 consolidated results reflects the strength and depth of our diversified portfolio. Our services businesses continue to increase their contribution to the overall results. Our results are also translating into a very strong Balance Sheet.”

- CEER

- Saudi Arabia

- Abdul Latif Jameel

- Zamil Trade & Services

- Zamil Plastics

- NSSPC

- KK Nag

- Mino

- FEV

- AVL

- MK Tron

- XYG

- Sika

- AITS

- FPI

- James DeLuca

CEER Inks 16 Agreements Worth USD 996 Million To Expand Saudi EV Supply Chain

- By MT Bureau

- February 10, 2026

CEER, Saudi Arabia’s first electric vehicle (EV) brand and Original Equipment Manufacturer (OEM), has signed 16 commercial agreements valued at over SAR 3.7 billion (USD 996.90 million). The deals were announced at the 4th PIF Private Sector Forum, following SAR 5.5 billion (USD 1.4 billion) in agreements secured at the previous year's event.

The partnerships are part of a localisation strategy that aims to source 45 percent of vehicle materials and components from Saudi companies by 2034. The supply chain will support CEER’s production plan of seven models over the next five years.

The agreements cover a range of essential automotive components and services:

- Fluids and Plastics: Abdul Latif Jameel (ALJ) will supply windshield washer fluid and EV coolants. Zamil Trade & Services and Zamil Plastics will provide brake fluids and aerodynamic covers.

- Materials and Polymers: NSSPC is contracted for PP resin and polymer compounds, while KK Nag will provide Expanded Polypropylene (EPP).

- Engineering and Infrastructure: Mino will install steel Body Shop equipment. FEV and AVL will provide engineering services.

- Manufacturing: MK Tron will produce small stampings, window regulators, and door hinges. FPI will supply front-end modules and XYG will provide glazing solutions.

- Chemicals and HVAC: Sika is contracted for structural adhesives and cavity baffles, while AITS will work on HVAC localisation.

The project is expected to contribute SAR 30 billion (USD 8 billion) to Saudi GDP by 2034 and improve the trade balance by SAR 79 billion (USD 21 billion). CEER estimates the creation of 30,000 direct and indirect jobs, aligning with the industrial diversification goals of Saudi Vision 2030.

James DeLuca, CEO, CEER, said, “These agreements are a cornerstone of CEER's wide and deep localisation strategy, which targets sourcing 45 percent of vehicle materials and components from Saudi companies by 2034. Our approach goes beyond mere assembly, we are utilising local raw materials and empowering Saudi companies to become global suppliers, directly contributing to Vision 2030’s mission to diversify the national automotive industry and drive sustainable economic growth.”

“These agreements represent a major step in building a comprehensive automotive ecosystem in the Kingdom. By using local materials and resources, attracting advanced technology and foreign investment, and localising the production of heavy and labour-intensive components, we aim to reduce CO2 emissions and create meaningful job opportunities for Saudi nationals,” added DeLuca.

Cars24 Introduces Refreshed Brand Identity

- By MT Bureau

- February 09, 2026

Cars24 has unveiled a refreshed brand identity, moving from its original transactional focus towards a car ownership ecosystem.

Founded in 2015, the company originally utilised an all-caps logo – CARS24 – to establish a presence in a fragmented market. The updated identity shifts the name to sentence case, Cars24, which the company states reflects maturity and a focus on trust.

The core of the redesign features an open circular logo. According to the company, this form represents the continuity of car ownership, where vehicles change hands and user needs evolve. The open shape is intended to signal flexibility rather than closure.

The brand has also replaced its traditional blue with a brighter shade. This ‘younger blue’ is intended to make the brand appear more attentive and human as it scales its operations.

The identity update was the result of over 1,200 hours of design and iteration. The goal of the project was to create a look that remains relevant as the company expands its services beyond buying and selling into broader ownership systems.

Vikram Chopra, Founder & CEO, Cars24, said, “When we started, being loud helped. But as the company and the team grew up, the work started speaking for itself. This change is about reflecting who we are today, calmer, more human and focused on earning trust over time.”

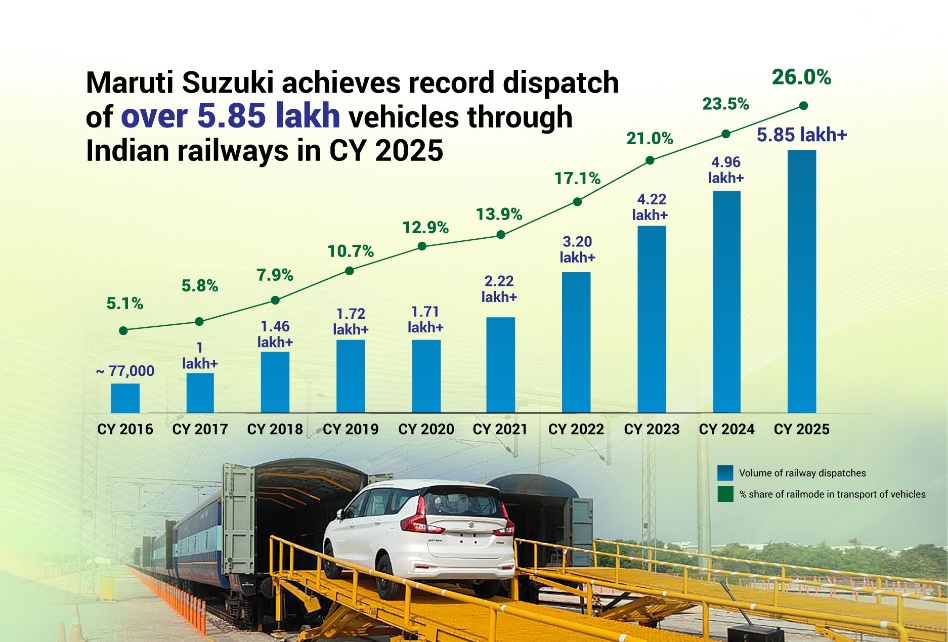

Maruti Suzuki India Increases Rail Dispatches To 585,000 Units, Up 18% In 2025

- By MT Bureau

- February 09, 2026

Maruti Suzuki India, the country’s largest passenger vehicle manufacturer, has reported the dispatch of over 585,000 vehicles using the railway network in CY2025, which marked an 18 percent growth compared to CY2024.

Over the last decade, the company's use of rail for outbound logistics has risen from 5.1 percent in 2016 to approximately 26 percent in 2025. The shift aims to reduce carbon emissions, oil imports and road congestion.

In 2025, Maruti Suzuki India inaugurated an in-plant railway siding at its Manesar facility. The company also became the first manufacturer to dispatch vehicles to the Kashmir valley using the railway bridge over the Chenab river.

Combined dispatches from in-plant sidings at Gujarat and Manesar accounted for 53 percent of the company's total rail volumes during the year. The manufacturer currently employs 45 flexi-deck rakes, with each train capable of transporting approximately 260 vehicles.

Combined dispatches from in-plant sidings at Gujarat and Manesar accounted for 53 percent of the company's total rail volumes during the year. The manufacturer currently employs 45 flexi-deck rakes, with each train capable of transporting approximately 260 vehicles.

The company was the first automaker to receive an Automobile-Freight-Train-Operator (AFTO) license in 2013. Since FY2014-15, it has transported more than 2.8 million vehicles to 600 cities using a hub-and-spoke model.

Hisashi Takeuchi, MD & CEO, Maruti Suzuki India, said, “The year 2025 marks our highest-ever rail dispatch, with over 585,000 units. During the year, we strengthened our green logistic efforts through two landmark events – the inauguration of India’s largest automobile in-plant railway siding at our Manesar facility and second was we dispatched vehicles by rail to Kashmir valley through the world's highest railway arch bridge over Chenab river, a first by any automobile manufacturer. Our mid-term goal is to increase rail-based vehicle dispatches to 35 percent by FY 2030-31, contributing to India’s net-zero ambition by 2070. Maruti Suzuki India has adopted a comprehensive ‘Circular Mobility’ approach to sustainability, aiming to reduce its carbon footprint across the entire vehicle lifecycle – from design and production to logistics and end-of-life vehicle (ELV) management.”

Comments (0)

ADD COMMENT