Q: What, according to you, are the skill gaps persist in the automotive industry still and how is ASDC addressing this?

Sanghi: Automotive manufacturers are currently facing several challenges. With increased pressure to meet customer demand for more personalised designs, they are tasked with creating a more flexible production environment, reducing engineering time and costs, and accelerating the market to remain competitive.

With massive technological transformations taking place across the sector, companies need to keep pace with the ever-evolving landscape to meet the ever-evolving demands of modern-day work.

Acquiring new skills is the key to sustain in this dynamic landscape. It is a continuous effort of both the institute and the corporation to fill the skill gap. Although there are programmes, they are not reflecting the change at the same pace as the change seen by the industry.

Companies today need people who can adapt and develop themselves to the changing technology. Whether automotive or otherwise manufacturers have recognised the importance of creating a workforce of intelligent problem solvers. In addition to these, more manufacturers are now focusing on hiring and training talents that can sustain advances in technology and drive investment. We at ASDC are doing a lot of training activities along with our teams of various zones, including holding webinars and launching various courses.

We are also continually training our team members and associates and dealers to do more reviews on the digital platforms or dealers to focus on digital retail; they were not getting used to it.

They preferred to be physically present, talking face to face, but now this lockdown has left no other option but to adopt the digital route.

Q: Customers are well informed now, and they finalise the model and variant even before reaching the showroom. In this scenario, what kind of skills needed for dealerships?

Sanghi: With ever-increasing ways to capture your customers’ attention across multiple channels, a partner specialising in the customer journey can be an invaluable asset to your business.

Considering the experience from the consumer’s perspective allows the dealer to compete with other, less traditional models.

Social distancing will bring dynamic change to the dealership business. No longer will customers feel comfortable walking into showrooms. Now, the reverse will happen, and OEMs and dealers will have to reach out to customers even more. And going digital will help them do just that.

Sales channels, dealers and OEMs per se will have to increase the transparency level dramatically. That’s because customers will now prefer to engage with them virtually, which in turn means there has to be digital.

Various experiences, like test drives of new cars, which has been a very popular method of selling a passenger vehicle, will be a much-less-used tool for sales. Likewise, a physical inspection of vehicles undergoing maintenance will take a backseat, and the OEM/dealer will have to convey images to customers about the work being done, either in real-time or in some other manner.

Q: Would the new trend catalyse unemployment further?

Sanghi: The pandemic has brought forth the concept of work from home to enable social distancing, which earlier would never have been thought to be possible for a vast majority of the jobs. You will need to train them (workforce) on how to use digital tools, and train the entire ecosystem to monitor the efficiency.

The need for top-notch cybersecurity is vital; one has to be absolutely sure that the data is secured and not misused. Data integrity needs to be 100 percent. Organisations will need to upskill existing staff to be digital and tech-savvy. All the while, the focus has to be on the data which is supposed to be the oil of the economy that is secured and owned by the owner, and not someone else.

Q: How do you match the curriculum with the ever-evolving customer needs and changing regulatory environment?

Sanghi: While the automotive industry may be facing some challenges, digital manufacturing and technological progress are enabling automotive engineers to deliver products to market faster than ever before.

This is easing the competitive pressure on car manufacturers, and going some way to fill the void left by the shortage of skilled engineers.

COVID-19 has introduced digitalisation as the key to the future. For organisations and the country, this means a huge opportunity to upskill and reskill our workforce using digital tools. This will not only help the country stabilise manufacturing activities, but will also help to improve the standard of living, that well allows for economic growth.

Q: What are the challenges you face with emerging technology trends like electrified, automated, shared technology as each of these elements needs specialised training supported by adequate infrastructure?

Sanghi: A big change happening because of digitalisation and COVID-19 has just helped increase the focus. The current lockdown has brought the focus on skilling and digitalisation into sharp focus. Smart industrialisation is here to say; one can look at their people’s daily lives, particularly in urban and some parts of rural India, to experience that they are now more reliant on digital tools than they were in pre-COVID-19 days.

While skills shortage is an issue far wider than the automotive industry, reasons can be identified why this sector has a lack of skilled workers. For the manufacturing sector, it means moving from labour-intensive methodologies to automation. COVID has accelerated the growth of the cyber-physical world. India should marry men with the machine to enhance productivity. Highly skewed income distribution and a lack of respect for labour remain a big concern. Lack of respect leads to lower productivity and efficiency, which serve to robs India of a competitive edge.

Q: The technological changes that are coming off late are mostly the result of either legislation or regulation. In this scenario, how do you see ASDC transform in the future?

Sanghi: Demand-driven skilling has been the focus of every industry. At ASDC, we’ve conceptualised the digital platform in such a way that it provides all the information together, at one place. For example, the availability of jobs in a sub-sector, what is the prediction for upcoming job roles and what are the skills in demand. It will provide links to all our partners wherein they can share their projections and find the right candidates.

There have been many modifications to the apprenticeship programmes, and these are rightly intended in making it inclusive. We are happy with the Government making these phenomenal improvements, and we hope the industry members engage more apprentices. For the automotive sector, ASDC is the delivery partner for apprenticeships. We also see a lot of enthusiasm from component manufacturers and dealers to explore apprenticeship as an option to get a skilled workforce.

Q: Today, almost all vehicles, including trucks, are connected in one way or the other. What are the new challenges that emerge out of these connected vehicles? What is the solution from ASDC?

Sanghi: The automotive industry is converging with the information and communication technology (ICT) industry at a rapidly increasing rate. Technology is reshaping the global automotive sector. In the future, cars will become computers on wheels as tech players’ move into the automotive sector to leverage their existing capabilities.

When we are talking about the challenges, it can be the difference in lifecycles in the automotive and the mobile industry is a serious challenge for the future of connected cars. New features, such as operating system upgrades and new applications, are provided almost constantly for the smartphone, whereas car manufacturers work on five-year cycles. The advent of connected cars will dramatically change the dealership model as a whole. Salespeople must plan to spend an hour or more teaching customers how to use their car’s advanced technology.

Also, issues such as privacy, security, the cost of deploying a system, data ownership, driver distraction, and equity must be taken into consideration in the technology of connected vehicles/cars.

Q: How is ASDC preparing itself to support the maintenance and repair of electric vehicles?

Q: How is ASDC preparing itself to support the maintenance and repair of electric vehicles?

Sanghi: Complex maintenance is one of the most common concerns that affect electric vehicle (EV) adoption. In reality, however, the intervals between each service in an EV are almost the same as for regular vehicles, and those services are usually less complicated. Traditional vehicles have hundreds of mechanical and moving parts, whereas an EV contains far fewer. Parts of an EV are generally easy to replace and don’t wear out as quickly.

The only major “potential” expense in EV maintenance is replacing the battery. As the vehicle reaches 100,000 miles, it may have lost up to 20% of its range.

Some batteries are designed to replace modules in contrast to the whole battery, but it depends on the way the car is made. Although it may take significantly less time to perform a service on an EV, there are other differences in the service process that can affect an OEM’s aftersales business.

We at ASDC have upgraded our training systems to look after the present modes of maintenance.

The way forward is our entire training programme is under review by industry partners. We have expert groups in R&D, manufacturing; they are in the process of reviewing all our occupational standards and upgrading them, not only for the present but also for the future.

Q: What is your view on data storing wirelessly that may affect multi-brand third-party service centres; how do you see ASDC playing a role in this?

Sanghi: Wireless connectivity for the vehicle may pose serious cybersecurity threats to a moving vehicle.

However, the issue of multi-brand third-party service centres, including service aggregator platforms, are here to stay.

ASDC in partnership with some of the industry partners is keen on providing Recognition of Prior Learning (RPL) for existing manpower as well as upskilling training of existing workers through blended digital learning modules for new technologies linked to new norms like BS-VI standards of emission, etc.

Q: What is ASDC’s work on conserving resources like use of remanufactured parts?

Sanghi: All stakeholders, including the current Government, have felt the need for a well-balanced vehicle scrappage policy; we expect to see its roll-out soon. This can boost a lot in refurbished and remanufactured parts. It opens a new sub-domain, generating employment and entrepreneurship opportunities. Once the policy contours are known, the training qualifications and standards will be worked upon by ASDC.

Q: What are the new courses ASDC is planning to conduct in the near future?

Sanghi: ASDC has started work on new job roles in the areas of Industry 4.0 for manufacturing and maintenance areas and the entire domain of electric vehicles. We are modifying some of the existing job roles to update the new technological changes and disruptions that have taken place in this industry. (MT)

Renault Doubles Down On India As A Strategic Export And Growth Hub

- By Nilesh Wadhwa

- March 10, 2026

As part of its evolving global roadmap, French automotive major Renault Group is increasingly aligning its strategy around a select set of high-growth markets, with India emerging as a critical pillar for the company’s future competitiveness.

Senior leadership indicated that the carmaker now views India not merely as a domestic sales market but as a full-fledged industrial and sourcing hub capable of strengthening its global supply chain. With localisation levels already exceeding 90 percent, the company believes the Indian ecosystem can play a significant role in improving cost competitiveness and supporting exports to other regions.

To accelerate this transformation, the Group strengthened its leadership structure in the India by appointing a Stephane Deblaise as its first Chief Executive Officer (CEO) to oversee the entire India operation. The move reflects a broader intent to deepen local decision-making and integrate the market more closely into Renault’s global strategy.

India and South America drive future trade opportunities

The company is also exploring the potential benefits of free trade agreements (FTAs) that could further strengthen export flows from India and South America.

Executives indicated that improved trade frameworks could enhance the role of India as a competitive production and sourcing base, particularly as global automakers reassess supply chains and regional manufacturing footprints.

At the same time, the company remains cautious in other global markets. Chinese suppliers currently account for around five percent of Renault’s global sourcing, and the group has no plans to re-enter the Chinese market in the near term.

A key shift in the group’s strategy since 2019 has been a move away from aggressively chasing volumes toward building stronger brand value and profitability.

Instead of pushing for market share in every region, Renault says it is focusing on markets where it can build a sustainable and profitable business case. The emphasis is now on delivering differentiated products, stronger customer value and improved quality rather than simply expanding volumes.

This philosophy is shaping the company’s approach to India as well.

Rather than targeting the entire market, Renault plans to focus on specific customer segments, particularly middle- and upper-income families seeking value-driven mobility solutions. The company believes that strengthening product positioning and improving residual values will ultimately support stronger brand perception.

India’s passenger vehicle market remains highly competitive, especially in the price band of EUR 15,000–20,000 vehicles, where global and domestic manufacturers are battling for share.

Historically, Renault established its presence in the country through entry-level offerings such as the Renault Kwid. However, the company is now looking to shift its brand positioning toward higher-value products.

The success of the Renault Duster in the past continues to shape Renault’s product roadmap, with the company describing the nameplate as a brand in itself in several markets. Building on this equity, Renault plans to introduce new SUV offerings that combine stronger design, advanced technologies and multi-energy powertrain options.

One such upcoming concept is the Renault Bridger, which the company believes could be a game changer in its product portfolio. Designed around flexible powertrain architectures, the model is expected to support multiple energy options as part of Renault’s broader global push toward electrified and hybrid mobility solutions.

The company emphasised that it is not starting from scratch in India, pointing out that millions of customers already drive Renault vehicles across the country.

Another major focus area for the group is accelerating product development cycles.

According to Renault’s leadership, one of the biggest challenges facing the global automotive industry today is the ability to develop new vehicles in less than two years while keeping pace with rapidly evolving technologies.

The company has already demonstrated faster development cycles in China and is now working to replicate that agility in Europe by integrating engineers and suppliers more closely into the product development process.

This approach could also influence Renault’s India strategy, particularly as the company looks to launch new products more quickly and respond faster to market shifts.

Strengthening downstream ecosystem

Beyond manufacturing and product strategy, Renault is also placing increasing emphasis on downstream value creation, including dealership networks, customer services and vehicle residual values.

Management believes that stronger engagement with dealers and improved lifecycle value for customers will be critical differentiators in markets like India, where brand perception and resale value play a significant role in purchasing decisions.

The company currently maintains capital expenditure and R&D spending below eight percent of revenue, while maintaining tight control over inventory levels, which average around EUR 1 billion globally.

While Renault acknowledges that its current market share in India remains modest, the company sees substantial long-term potential in the country’s rapidly expanding passenger vehicle market.

With a renewed focus on SUVs, high localisation levels and a shift toward value-driven products, the French automaker believes it has a credible opportunity to rebuild momentum in the market.

For Renault, the strategy is clear: rather than chasing scale at any cost, the company intends to grow selectively and profitably, with India playing an increasingly central role in its global ambitions.

Renault Bets Big On India For Manufacturing & Sourcing, Bridger SUV Production & Launch In India In 2027

- By Nilesh Wadhwa

- March 10, 2026

French automotive major Renault Group, which unveiled its mid-term business strategy ‘futuREady’, will see India playing a huge role in its ambitious growth plan.

Fabrice Cambolive, CEO, Renault Brand, has stated that the company’s upcoming Bridger SUV, slated to be a key driver for growth, will go into production by next year.

What’s more, the sub-4-metre tech-loaded Bridger SUV touted as the company's flagship for the international markets with a spacious 400-litre boot, will see India as its first market before being exported to other countries.

As part of its future plans, the Bridger SUV will be a multi-energy vehicle, which means petrol, electric vehicle and a hybrid engine to enable transition towards EV.

While full details of the product will be revealed closer to launch, the company has clearly stated that outside Europe, India, South America and South Korea are key growth regions.

While full details of the product will be revealed closer to launch, the company has clearly stated that outside Europe, India, South America and South Korea are key growth regions.

The high-growth markets with an estimated 50 million units per annum, represent 60 percent of total industry volume growth where Renault Group is present.

Renault Group’s futuREady Plan To See 36 New Model Launches By 2030

- By MT Bureau

- March 10, 2026

French automotive major Renault Group has launched its new strategic roadmap, titled futuREady, marking the next phase of its corporate transformation following the 2021 ‘Renaulution’ plan. The strategy aims to establish the Group as a benchmark European carmaker through an offensive in products, technology and operational performance.

The Group has set medium-term financial targets including an operating margin between 5 percent and 7 percent and an average automotive free cash flow of at least EUR 1.5 billion per year.

Product Offensive and Global Growth

Renault Group plans to launch 36 new models globally by 2030. The strategy focuses on two distinct geographic tracks:

- Europe: 22 new models, of which 16 will be electric. The Renault brand aims for 100 percent electrified sales in this region by 2030.

- International: 14 new models targeted at growth hubs in India, South America, and South Korea. The Group expects 50 percent of Renault brand sales to come from outside Europe by the end of the decade.

A cornerstone of the plan is the RGEV Medium 2.0 electric platform. This modular 800-volt architecture is designed to reduce costs by 40 percent compared to current electric vehicles.

Technical specifications for the 2030 horizon include:

- Charging: Ultra-fast charging capability of 10 minutes.

- Range: Up to 750 km (WLTP) for pure electric versions and 1,400 km with a range extender.

- Software: Transition from Software Defined Vehicles (SDV) to Artificial Intelligence Defined Vehicles (AIDV), with 90 percent of functions updated via Firmware Over The Air (FOTA).

- Powertrain: A third-generation rare-earth-free motor (EESM) delivering 275 hp with 93 percent motorway efficiency.

Renault Group intends to halve factory downtime and reduce energy consumption by 25 percent through the use of an industrial metaverse – a digital twin of all manufacturing sites. The plan involves deploying 350 humanoid robots for low value-added tasks and using AI to supervise 1,000 manufacturing control points. These measures aim for a 20 percent reduction in production costs and a 30 percent reduction in logistics costs.

Francois Provost, CEO, Renault Group, said, “futuREady, our new strategic plan, is a crucial step in the future of Renault Group. In an environment that is even more competitive, we can build on solid fundamentals: our brands, our products and our financial results. Since my appointment as CEO last July, we have been working with the whole team worldwide to develop a plan that will set the Group on the path to robust and sustainable performance, whatever the challenges ahead.”

“Becoming Europe's reference carmaker means setting the ambition to design and produce in Europe products that are best in class in terms of desirability, technology and competitiveness. In an increasingly competitive environment, this means combining performance and innovation with resilience and robust strength,” added Provost.

| RENAULT futuREady PLATFORM EXPLAINED | |

| RGMP small | Modular platform, B & C segments |

| RGEV small | Electric platform, A & B segments |

| RGEV medium 1.0 | Electric platform, C segment 1st generation |

| RGEV medium 2.0 | Electric platform, C & D segments 2nd generation |

| RGMP medium | Modular platform, C&D segments |

| RGMP pick-up | Modular platform, pick-up |

| RGEV medium van | Electric platform, medium LCV |

| APP | Alpine platform |

| RGEA | Adaptation of the Geely GEA platform |

| RGEP | Multi-energy platform, entry level |

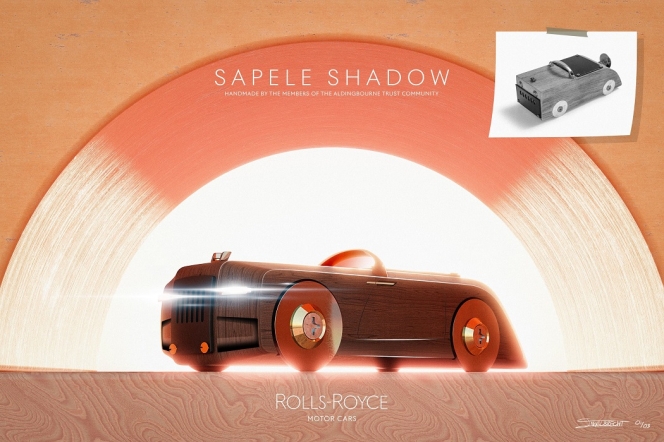

Rolls-Royce Crafts Exclusive Artwork In Support Of Aldingbourne Trust

- By MT Bureau

- March 09, 2026

Rolls-Royce Motor Cars has marked the conclusion of its year-long partnership with Aldingbourne Trust by presenting the charity with a series of exclusive artworks. These pieces were created by the luxury marque’s in-house design team and inspired by a wooden model gifted to Rolls-Royce by the Trust late last year.

That model, named the ‘Sapele Shadow’ after the wood used in its construction, was made by the Wood@Aldingbourne team as a gesture of gratitude when Rolls-Royce delivered its final donation. Now displayed at the company’s Goodwood headquarters, the handcrafted vehicle prompted one of the marque’s designers to reinterpret it digitally using the same advanced rendering software applied for client commissions.

Only three framed prints of this original artwork have been produced, each signed and numbered by the designer. One is set to be displayed in the Aldingbourne Trust café, another has been presented to the Wood@Aldingbourne workshop and the third will be auctioned to support the charity during the Goodwood Members’ Meeting in April.

Wood@Aldingbourne is one of over a dozen social enterprises run by the Trust, which has supported more than 1,500 individuals with learning and physical disabilities since its founding in 1978. Operating as a self-funding environmental group, it collects and repurposes reclaimed wood from local sources, including the Rolls-Royce site. All materials are either transformed into handmade goods for sale or used to fuel the Trust’s biomass boiler.

The relationship between Rolls-Royce and Aldingbourne Trust extended beyond fundraising throughout 2024, with colleagues contributing both time and resources. This ongoing collaboration reflects the meaningful connections formed when employees engage with their chosen House Charity, often resulting in support that endures well beyond the official partnership.

Andrew Ball, Head of Corporate Relations, Rolls-Royce Motor Cars, said, “It was a privilege to work with Aldingbourne Trust as our House Charity in 2024. When we presented the final donation cheque, we received an unexpected gift – a model car made in Sapele wood by the Wood@Aldingbourne team. This delightful model inspired one of our designers to create a unique digital rendering, just as we would for a real client commission. We’re delighted that this artwork will be displayed in the Trust’s café and will also be offered as a significant prize in a fundraising auction. It’s a pleasure to extend our support for this wonderful organisation beyond 2024.”

Abigail Rowe of Aldingbourne Trust said, “We were so appreciative of the fundraising efforts by Rolls-Royce staff, and the tremendous awareness we were able to generate through being their House Charity. It’s wonderful that the relationship has continued through this collaboration, which meant so much to the client who created the original wooden model, and will help raise further money for us. We’d like to thank the whole Rolls-Royce team, and particularly the talented designer who created these images for us.”

Comments (0)

ADD COMMENT