- voice

- India

- car market

- staring

- stagnancy

- selling

- foreign investors

- stock market

- decline

- issues

- structural

- geopolitical

- local

- global

- auto industry

- largest contributor

- GST

- exchequer

- local

- global

- nature.

Rough Road Ahead For the Indian Auto Industry?

- By Bhushan Mhapralkar

- March 12, 2025

The voice about India’s car market staring at stagnancy is growing amid much selling by foreign investors in the stock market. Auto sticks of OEMs and suppliers have taken a beating lately. The reasons for stock market decline are said to be structural issues as well as geopolitical issues. In other words, they are local as well as global in their nature. The Indian auto industry – as the largest contributor of GST to the exchequer and among the highest contributor to the country's manufacturing GPD – is also quite local and global in its ways of working.

Like any other developing nation, it is a market where the scope for an increase in automobile population is bright. It is also a market that is beset by structural issues nonetheless. With 34 cars owned per 1,000 people, the country with a population estimated to be 1,463,865,525 in 2025 has ample scope for auto sales growth.

But as banks struggle for liquidity and a reduction in repo rate by the apex bank fails to reflect in the reduction of loan interest rates or equated monthly instalments, the structural issues facing the automobile industry are too stark to overlook.

Adding to the structural issues are perhaps developments such as the recent announecement by Maharashtra Government to levy six percent motor vehicle tax on premium electric vehicles. The leading industrialised state also has among the highest road toll taxes among other Indian states. The highway network in the state is among the most lacking and unsafe. Most roads in the state have either deteriorated or are under a seemingly unending period of repairs.

The state government in its 2025 budget has also announced that it has raised the motor vehicle tax by one percentage point on individual-owned non-transport four-wheeler CNG and LPG vehicles. Such vehicles currently attract a seven to nine percent tax depending on their type and price.

While electricity costs have been rising with distribution companies like MSEDCL pushing for a revision in fixed and energy charges for various categories in order to bridge revenue gap, owning electric vehicles and CNG vehicles is becoming costlier though eco-friendlier.

Attracting over 200 percent in taxes, petrol and diesel prices have been at an all-time high. A timely upward revision in toll prices is only adding further to the cost of motoring in a country where close to or more than 50 of the vehicle purchase price amounts to taxes. Spares are also taxed at a hefty 28 percent and the labour costs have steeply risen post Covid-19 pandemic.

With vehicle prices being jacked up by automakers under the pretext of rising input costs by about four to five percent if not more, the Indian auto industry is clearly under pressure to maintain its margins and stay profitable.

Against the operating costs, the foot falls in the showroom are taking longer to realise into actual sales. Discounts are gaining speed and indicative of sales losing stream in some of the segments that were until recently doing very well.

Any excitement about a rebate in Income Tax up to INR 1,200,000 – it takes over INR 1,000,000 to purchase a decent car in India today – seeming to have faded into thin air, the talk about government announced a reduction in GST taxes has gained speed. When it would actually come into effect is yet to be known but the narrative has started building. The stock market does not look excited however and the money lost by domestic investors may take a long time to come back, it seems.

As US President Donald Trump speaks about exposing India’s ‘wrong’ tariff policies in the absence of any statement from the Indian government striking out his claims, the Indian market for automobiles and other consumer goods looks destined for a rough ride. Stagnancy will be a part of the plot, the repercussions of which would stem from domestic structural issues as well as geopolitical shifts where calls like ‘China Plus One’ hold no value at all anymore.

With the entry of Tesla – which has seen its sales and stock prices plummet in many of existing markets off late – set to enter India with the government lowering tariff under pressure from the US President, the subject of too much regulation needs to be examined in terms of structural strength and the industry’s ability to be competitive. Local manufacture is also a subject that needs to be looked at as MSME sector continues to shrink and take down with it the PMI index.

Skilling is also a subject that should be looked at as engineering courses lose interest with the young in the country. A manufacturing-less economy that is also witnessing the services sector face a slowdown – again due to structural and geopolitical issues – may not spell a good omen for growth in the long run. This, particularly in the case of a country whose median age in 29 years.

China’s ‘Deep seek’ has shown how the prowess in technology can shift overnight and highly influence the economy of a nation, its stock markets suddenly. In India, the auto industry should nurture the MSME sector as much as the government should. A services alternative in terms of growth over manufacturing may not hold forth in the long-term. Manufacturing exports can shrink abruptly anytime under the shifting regulatory and other market issues in the domestic marketplace and under the shifting geopolitical situations in various parts of the world that also make lucrative export markets.

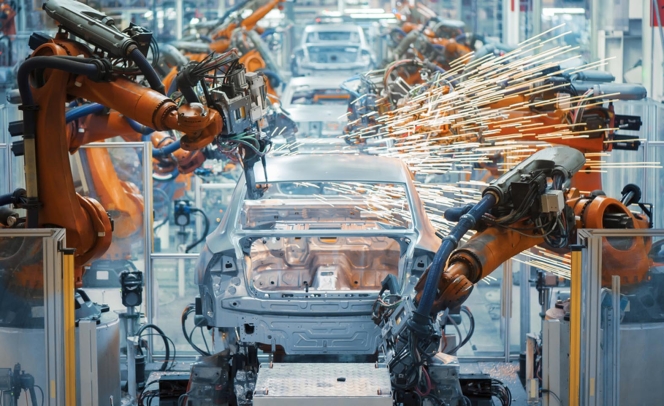

Image for representative purpose only.

UTAC Establishes Strategic Hub In Anhui To Lead Automotive Testing In China

- By MT Bureau

- March 07, 2026

UTAC, a prominent player in the automotive testing, inspection and certification sector, is significantly broadening its footprint in China. The company has unveiled plans for a cutting-edge proving ground in Huainan, situated in the central province of Anhui. This ambitious project is being developed through a collaboration with the Huainan City Government and is set to become the primary strategic hub for the UTAC Group’s operations within the country. By establishing this facility, UTAC aims to bolster the mobility industry with top-tier testing capabilities and specialised knowledge.

The new site will enable UTAC’s team of specialists to offer homologation and testing services that align with the most current international benchmarks and regulatory standards. This initiative is a direct continuation of the group’s overarching goal to foster a mobility landscape that is both safer and more environmentally friendly. The Huainan facility is designed to be comprehensive, featuring a variety of specialised tracks for vehicle testing, along with a technology park that includes rentable workshops and office spaces. It will also house a dedicated conference and exhibition centre and purpose-built laboratories outfitted with state-of-the-art equipment. These labs will be specifically geared towards testing the latest advancements in new energy vehicles.

Anhui province itself provides a rich environment for such an investment. Home to 70 million people, it hosts a dense and extensive mobility ecosystem. Major automotive manufacturers like BYD, Changan, Chery, JAC, NIO and Volkswagen, together with their extensive supply networks, are deeply embedded in the region. The province’s manufacturing prowess is underscored by its production of roughly 3.7 million vehicles in 2023, a figure that positions Anhui as China’s leader in overall vehicle manufacturing, new-energy vehicle production and vehicle exports. Consequently, the new proving ground in Huainan is poised to become a vital strategic component for UTAC, solidifying its presence in this central hub of the Chinese mobility industry.

Connor McCormack, CEO, UTAC, said, " We are extremely proud of our partnership with the city of Huainan, which is undergoing a significant transformation to support the future of the automotive industry. UTAC is delighted to contribute to this transformation and to bring our 100 years of specialist expertise, along with the European standards we have helped shape and validate, to China’s vital automotive sector.”

Mayor Zhang Zhiqiang of Huainan City said, “This represents a significant milestone in Huainan's efforts to accelerate the development of its intelligent connected vehicle industry. It is of great importance in bridging the critical gap in the regional automotive sector’s industrial chain of ‘testing-production-export' and establishing a specialised vehicle testing and certification platform with international recognition. The successful cooperation on this project will undoubtedly advance the high-end and intelligent transformation of the regional automotive industry, providing strong impetus for Anhui Province's efforts to foster a new energy vehicle industrial cluster with international competitiveness.”

Gulf Oil Renews Partnership With Chennai Super Kings For Four Years

- By MT Bureau

- March 06, 2026

Gulf Oil Lubricants India, a Hinduja Group company, has announced a four-year extension of its partnership with the Chennai Super Kings (CSK). Gulf will serve as the Official Lubricants Partner for the franchise, continuing an association that has spanned 13 seasons.

The renewal maintains one of the longest-running brand partnerships in the Indian Premier League (IPL). The collaboration focuses on consumer engagement through marketing campaigns and fan-focused initiatives.

The 13-season history between Gulf and CSK has been a central part of Gulf’s brand strategy in India. The company uses the platform to reach cricket fans through digital activations and on-ground experiences.

This follows the recent announcement of fellow Hinduja Group company, Ashok Leyland, joining CSK as an official sponsor.

Ravi Chawla, Managing Director & CEO, Gulf Oil Lubricants India, said,“Gulf’s 13-season journey with CSK reflects a relationship built on trust, shared passion, and mutual success. This partnership has consistently delivered far beyond the commercial contract, forging a deep emotional connection with the loyal CSK fan base and cricket enthusiasts across the nation. Continuing this association is a proud moment for Gulf as it reflects our global heritage of supporting performance sports and iconic teams that inspire millions of fans.”

KS Viswanathan, Managing Director, Chennai Super Kings, stated, "We are pleased to continue our long-standing association with Gulf, a partner that has been with us through many memorable seasons. Over the years, Gulf has consistently brought creativity and energy to the partnership while engaging with our fans. We look forward to strengthening this relationship over the next four years. We are really pleased about how it has come together"

Volvo Marks 70 Years Of Seatbelt Innovation With Intelligent New Multi-Adaptive System

- By MT Bureau

- March 06, 2026

Volvo Car UK is marking a major milestone in automotive safety this year, celebrating seven decades of pioneering seatbelt innovation with a groundbreaking new system in the EX60 model. This latest development represents the world’s first multi-adaptive safety belt.

The brand’s legacy began in 1956, when the Volvo Amazon prototype was fitted with a two-point diagonal chest belt, making it one of the first European vehicles to offer such a feature. Just three years later, Volvo made history by becoming the first manufacturer to fit three-point seatbelts as standard. This design, created by engineer Nils Bohlin, combined a lap belt with a diagonal strap anchored at a low point beside the seat, establishing the template for the safety belts found in every modern vehicle.

Volvo’s commitment to saving lives was further demonstrated when it made the three-point belt patent available to all competitors free of charge. This altruistic move accelerated the widespread adoption of seatbelts globally and helped fast-track legislation making them a legal requirement, ultimately saving millions of lives. The engineering principles established 70 years ago continue to inform modern Volvos, with the new EX60’s multi-adaptive belt representing the latest evolution.

This advanced system leverages real-time data from interior and exterior sensors to tailor protection for each individual occupant. It considers factors like height, weight and seating position, adjusting its response based on the specific crash scenario. For instance, a larger occupant in a severe collision would receive a higher belt load to mitigate head injury risks, while a smaller person in a minor incident would experience a lower load to protect against rib fractures. Crucially, the system is designed to learn. Through over-the-air updates, the vehicle can continuously refine its understanding of occupant dynamics and crash responses, ensuring the technology improves throughout the car's life. This landmark achievement arrives as Volvo prepares to celebrate its centenary in 2027.

Nicole Melillo Shaw, Managing Director, Volvo Car UK, said, “Volvo has always been at the forefront of safety evolution and innovation, and we’re pleased that we can continue to make new developments on such vital features like the seatbelt. The latest multi-adaptive seatbelt in the new EX60 is a testament to our pioneering technology and approach to safety that is continued today.”

TKM And Maharashtra Government Forge Ahead With Major ITI Skilling Initiative

- By MT Bureau

- March 05, 2026

Toyota Kirloskar Motor (TKM) has taken a significant step in its ongoing collaboration with the Government of Maharashtra by completing the upgrade of the Government ITI Deogiri in Chhatrapati Sambhajinagar. This development is part of a broader Memorandum of Understanding aimed at enhancing the state’s network of Industrial Training Institutes. The company has already facilitated the modernisation of 16 ITIs across the Marathwada and Nagpur divisions. The core objective of this partnership is to uplift rural youth by providing them with advanced technical training, thereby preparing them to become skilled technicians ready to support India’s expanding industrial sector.

A structured three-pillar strategy has been established to drive this transformation. The first pillar concentrates on educator development through specialised training programmes and workshops, including sessions held at Toyota’s facility in Bidadi. The second involves equipping the institutes with modern tools and learning materials, such as fundamental skill training kits and visual aids, to create an industry-relevant learning environment. The third pillar is dedicated to instilling a strong work culture by integrating practices that promote discipline, safety and environmental awareness. This holistic approach aims to cultivate graduates who not only possess technical expertise but also demonstrate integrity and a sense of social responsibility.

The rollout is planned in three distinct phases. Following the completion of the first phase covering 17 ITIs in the Marathwada and Nagpur regions, the subsequent phases will extend the initiative to the Amravati and Nashik divisions and finally to the Mumbai and Pune divisions by 2030. With the upgrade of ITI Deogiri, the institution now serves as a blueprint for this scalable skilling framework. Starting this academic year, it will begin offering training in both manufacturing and service domains to align with current industry demands. This long-term project, which ultimately aims to uplift 45 ITIs across the state, reinforces the national Skill India Mission by leveraging global manufacturing insights to address local skill development needs.

Mangal Prabhat Lodha, Minister of Skill, Employment, Entrepreneurship & Innovation, Government of Maharashtra, said, “Our youth are the foundation of Maharashtra’s future, and by nurturing their skills and aspirations, we are building a self-reliant society. This collaboration with TKM reflects our commitment to providing young people with industry-relevant training that enhances their confidence, employability and contribution to nation-building. Such initiatives ensure that our students are ready for the future to drive the country's growth story."

Vikram Gulati, Executive Vice President – Corporate Affairs and Governance, Toyota Kirloskar Motor, said, “At Toyota Kirloskar Motor, we firmly believe that the youth in rural India deserve the same opportunities as those in urban centres. Our vision is to empower them with world‑class technical capabilities so they can excel in their careers and contribute meaningfully to the nation’s progress. Guided by our philosophy of ‘Grow India, Grow with India’ and our mission of ‘Producing Happiness for All’, this initiative underscores our commitment to strengthening skilling at the grassroots level. As India moves towards the vision of Viksit Bharat 2047, we are dedicated to enabling equitable access to industry‑relevant skills that uplift communities and build a more resilient future.”

Comments (0)

ADD COMMENT