Turtle Wax Aims To Be Leader In DIY Segment In India

- By Sharad Matade

- December 19, 2020

Turtle Wax, a global name in the car care industry, entered the Indian market this year. With its aggressive plans and the ongoing demand for car care products, the company aims at becoming one of the largest care car product suppliers in Doing It Yourself (DIY) segment, besides, establishing a strong presence in Do-It-For-Me (DIFM) space.

According to Sajan Murali Puravangara, Country Manager and Director, Turtle Wax India, the car care industry is an integral part of the automotive industry, and changing buying preference from the mileage, and low maintenance to aesthetics, safety, comfort and features are fuelling demand for car care products.

“India has been witnessing good growth in car sales in last decade, whereas in the last five years, we see traction in the car care industry on account of changing trends or reasons to buy a car. In recent years, the way people look at the car has changed. They buy cars for the looks and features, and that also led to an interest to keep their cars new, tidy and clean; this is bringing demand for car care products. The interest is also coming from the mass car segment. In the last two years, we are getting the indication that the car care industry will be the next sunshine industry in the future,” explained Puravangara.

Turtle Wax, a family-owned company, has been in the car care business for nearly 75 years and operates in over 120 countries. Before establishing its third subsidiary in India, the company has been operating with two subsidiaries- the US and Europe.

India has a population over 1.3 billion and only 22 people out of a thousand own car, while in the US and UK, 980 and 850 per 1,000 individuals have a car, respectively. The massive headroom for the car segment in the next one-and-a-half-decade will trigger further growth for the car care segment in the long term, opines Puravangara.

According to a research report, the current car care industry in India is slightly less than one billion USD and expected to reach $1.44 billion in 2027. Explaining the growth factors, the report says, people usually keep their cars for more than seven years in India, and hence car care products are being increasingly used to restore the paint and for detailing and interiors. Along with this, many car care product manufacturers from Europe and North American markets have their presence in India through e-commerce websites and strong dealership networks. The same report adds that by 2027, the interior car care product segment will be around of $0.73 billion, while the exterior car product market will grow to USD 0.7 billion.

Consumer behaviour, cheap labour, and lack of necessary know-how make the Indian car care industry more challenging for the companies to operate in the DIY space.

In western countries, cars are a part of the family, and family members take basic care. In the US and other developed countries, the DIY segment is about 80 percent of the total car care industry; however, in India, it is of around 30 percent. “In countries like India, due to the hectic work schedule and cheap labour, DIFM dominates in the car care segment. There is always a third person to take basic care of cars in India. Coupled with this, the know-how is fairly lower in India when it comes to basic things such what wax can do to your car and what are the ways to protect cars’ interior and exterior,” Puravangara said.

However, the pandemic in the last eight months has proven useful for the car care segment. “We have seen momentum in the DIY business in the last six months. Since people have been at home, they have a lot of time at their disposal. They find time to take care of their cars. We are also seeing people are increasingly enquiring on different social media platforms on how to take care of their cars and sharing other issues,” he said.

As a part of the strategy to penetrate its products, the company will heavily focus on educating consumers on primary car care and the company’s products. “Being a global leader in the car care industry, it is our top priority to educate people on car care, know-how and our product usages and benefits.”

In the next three to four months, the company will start campaigns on social media channels. The campaign will invite consumers with their queries or to share their experience and issues.

“The company will also bring out videos on how to use our products and use the social influencers on YouTube and Instagram,” Puravangara said.

Though India is seeing a growing number of women behind in the wheel, the car care industry is yet to consider women as their potential customers. However, Turtle Wax understands the role of women in the overall automotive industry and expects the growing number of women car owners evidently will reflect in the car care industry.

To widen its customer base, the company will also promote the car wash as a family celebration where family members will take participate in washing, cleaning and taking care of the car. “Washing and cleaning cars is a family affair in many countries, and therefore the company will be promoting the same in India as well,” added he.

However, external factors that also possess further challenges for car care products. Considering vast territories, different weather, pollutions and scarcity and quality of water put car care product performance under severe pressure. Keeping the external challenges in mind, the company plans to bring in products that are suitable to the Indian markets.

“A larger challenge is not only the availability of water but the hard water which leaves marks on the car. Coupled with this, extreme temperature and dust and pollution affect the car. We are bringing in the products that will take care of cars in the Indian environment. We have asked the company to make products suitable for the Indian market,” said the executive.

Currently, the company offers the products required to clean, shine and protect the car inside out. The product portfolio includes shampoo to clean, wax to shine and various interior cleaners in the form of foam and liquid to clean the interiors of the car. It also offers various speciality products like trim restorer, chrome polish, headlight lens restorer, Odor-X Odor removing solutions, etc. to address specific car care requirements. Turtle Wax also has a ceramic coating that has 10H hardness which gives the high gloss, ultra-hydrophobicity, extreme chemical resistance, UV protection and easy cleaning properties. The company plans to bring in graphene-based ceramic coating solutions, which is the new technology in the car care industry.

The company is planning to bring 75th-anniversary Ceramic Paste Wax in Q1 2021, and will also introduce windshield washer fluid shortly in India. Other products from the company for the India market include all-metal polish that polishes all metal surfaces of the car’s exterior; Glass cleaner to keep the glass streak-free during the ride; ClearVue Rain Repellent that helps get better visibility during the monsoon rains; Trim Restorer since the Trims fades here in India more than the rest of the world and Windscreen washer fluid to remove the dirt and grime from the windshield glass.

The company will also introduce waterless washing products that cater to areas where water is scarce. The company’s waterless wash and wax has advanced polymer technology that lifts dirt to prevent starching, while the enriched wax gives a shiny and protective finish. Its rain repellent formula prevents watermarks and extends time in between cleaning.

The company will also bring in its Turtle Wax Hybrid Solutions ICE Seal N Shine, premium car paint sealant. The ICE Seal N Shine gives the car a layer of super-hydrophobic silicone for up to six months of protection against streaks, scratches and swirls.

To set up its network, the company will go through a distribution route and for which it has selected 23 cities, which have larger car density. Turtle Wax India is appointing own distributors in these cities who will take care of retailers and workshops. It has also identified another 48 towns in which it will supply products to dealers who will provide the products in the respective markets.

“We will have our main presence in all metro cities including Chennai, Hyderabad, Bangalore, Delhi-NCR, Kolkata, Pune, Mumbai, and additional upcoming cities like Ahmedabad, Coimbatore, Cochin, Surat etc,” he added.

The company plans to have about 10,000 outlets by the end of next June. Turtle Wax India has also set up the car care studios in Pune, Bangalore and New Delhi. The studio will be not based on a franchise concept; instead, it will be a co-branded activity. “We provide our products and branding support, but the studios also keep their brand identity,” he said. The company also has plants to have such studios in its 23 cities.

Puravangara declined to share the current revenue and future commercial targets but said sales numbers are increasing with each passing month. Currently, the company is importing its products from global subsidiaries, but he said the company will have a look into setting up local production capabilities. “The way it is going, we will have to do something locally as well. I don’t think we will be able to manage (the demand) with our global support when the demand goes up,” he said.

The company is looking for an option of re-packaging under which it will get bulk products and repack for the domestic market. “We will also see if some India oriented products will be manufactured here, completely. Those options are quite open,” he added.

Many Indians are using hair shampoo sachets to wash cars. When asked whether the company is looking to introduce car wash shampoo in sachets, he said it will not look into sachet option but will be looking to have a bottle of 100 to 200 ml. “We are still looking at those options of small bottles, but per wash, cost increases with smaller bottles,” he added.

Talking on the challenges, he said, it is on finalising the complete product portfolio that suits to the rapidly changing requirements of the Indian market. “We need to keep reinventing on products to be a leader in the market,” he concluded. (MT)

Renault Doubles Down On India As A Strategic Export And Growth Hub

- By Nilesh Wadhwa

- March 10, 2026

As part of its evolving global roadmap, French automotive major Renault Group is increasingly aligning its strategy around a select set of high-growth markets, with India emerging as a critical pillar for the company’s future competitiveness.

Senior leadership indicated that the carmaker now views India not merely as a domestic sales market but as a full-fledged industrial and sourcing hub capable of strengthening its global supply chain. With localisation levels already exceeding 90 percent, the company believes the Indian ecosystem can play a significant role in improving cost competitiveness and supporting exports to other regions.

To accelerate this transformation, the Group strengthened its leadership structure in the India by appointing a Stephane Deblaise as its first Chief Executive Officer (CEO) to oversee the entire India operation. The move reflects a broader intent to deepen local decision-making and integrate the market more closely into Renault’s global strategy.

India and South America drive future trade opportunities

The company is also exploring the potential benefits of free trade agreements (FTAs) that could further strengthen export flows from India and South America.

Executives indicated that improved trade frameworks could enhance the role of India as a competitive production and sourcing base, particularly as global automakers reassess supply chains and regional manufacturing footprints.

At the same time, the company remains cautious in other global markets. Chinese suppliers currently account for around five percent of Renault’s global sourcing, and the group has no plans to re-enter the Chinese market in the near term.

A key shift in the group’s strategy since 2019 has been a move away from aggressively chasing volumes toward building stronger brand value and profitability.

Instead of pushing for market share in every region, Renault says it is focusing on markets where it can build a sustainable and profitable business case. The emphasis is now on delivering differentiated products, stronger customer value and improved quality rather than simply expanding volumes.

This philosophy is shaping the company’s approach to India as well.

Rather than targeting the entire market, Renault plans to focus on specific customer segments, particularly middle- and upper-income families seeking value-driven mobility solutions. The company believes that strengthening product positioning and improving residual values will ultimately support stronger brand perception.

India’s passenger vehicle market remains highly competitive, especially in the price band of EUR 15,000–20,000 vehicles, where global and domestic manufacturers are battling for share.

Historically, Renault established its presence in the country through entry-level offerings such as the Renault Kwid. However, the company is now looking to shift its brand positioning toward higher-value products.

The success of the Renault Duster in the past continues to shape Renault’s product roadmap, with the company describing the nameplate as a brand in itself in several markets. Building on this equity, Renault plans to introduce new SUV offerings that combine stronger design, advanced technologies and multi-energy powertrain options.

One such upcoming concept is the Renault Bridger, which the company believes could be a game changer in its product portfolio. Designed around flexible powertrain architectures, the model is expected to support multiple energy options as part of Renault’s broader global push toward electrified and hybrid mobility solutions.

The company emphasised that it is not starting from scratch in India, pointing out that millions of customers already drive Renault vehicles across the country.

Another major focus area for the group is accelerating product development cycles.

According to Renault’s leadership, one of the biggest challenges facing the global automotive industry today is the ability to develop new vehicles in less than two years while keeping pace with rapidly evolving technologies.

The company has already demonstrated faster development cycles in China and is now working to replicate that agility in Europe by integrating engineers and suppliers more closely into the product development process.

This approach could also influence Renault’s India strategy, particularly as the company looks to launch new products more quickly and respond faster to market shifts.

Strengthening downstream ecosystem

Beyond manufacturing and product strategy, Renault is also placing increasing emphasis on downstream value creation, including dealership networks, customer services and vehicle residual values.

Management believes that stronger engagement with dealers and improved lifecycle value for customers will be critical differentiators in markets like India, where brand perception and resale value play a significant role in purchasing decisions.

The company currently maintains capital expenditure and R&D spending below eight percent of revenue, while maintaining tight control over inventory levels, which average around EUR 1 billion globally.

While Renault acknowledges that its current market share in India remains modest, the company sees substantial long-term potential in the country’s rapidly expanding passenger vehicle market.

With a renewed focus on SUVs, high localisation levels and a shift toward value-driven products, the French automaker believes it has a credible opportunity to rebuild momentum in the market.

For Renault, the strategy is clear: rather than chasing scale at any cost, the company intends to grow selectively and profitably, with India playing an increasingly central role in its global ambitions.

Renault Bets Big On India For Manufacturing & Sourcing, Bridger SUV Production & Launch In India In 2027

- By Nilesh Wadhwa

- March 10, 2026

French automotive major Renault Group, which unveiled its mid-term business strategy ‘futuREady’, will see India playing a huge role in its ambitious growth plan.

Fabrice Cambolive, CEO, Renault Brand, has stated that the company’s upcoming Bridger SUV, slated to be a key driver for growth, will go into production by next year.

What’s more, the sub-4-metre tech-loaded Bridger SUV touted as the company's flagship for the international markets with a spacious 400-litre boot, will see India as its first market before being exported to other countries.

As part of its future plans, the Bridger SUV will be a multi-energy vehicle, which means petrol, electric vehicle and a hybrid engine to enable transition towards EV.

While full details of the product will be revealed closer to launch, the company has clearly stated that outside Europe, India, South America and South Korea are key growth regions.

While full details of the product will be revealed closer to launch, the company has clearly stated that outside Europe, India, South America and South Korea are key growth regions.

The high-growth markets with an estimated 50 million units per annum, represent 60 percent of total industry volume growth where Renault Group is present.

Renault Group’s futuREady Plan To See 36 New Model Launches By 2030

- By MT Bureau

- March 10, 2026

French automotive major Renault Group has launched its new strategic roadmap, titled futuREady, marking the next phase of its corporate transformation following the 2021 ‘Renaulution’ plan. The strategy aims to establish the Group as a benchmark European carmaker through an offensive in products, technology and operational performance.

The Group has set medium-term financial targets including an operating margin between 5 percent and 7 percent and an average automotive free cash flow of at least EUR 1.5 billion per year.

Product Offensive and Global Growth

Renault Group plans to launch 36 new models globally by 2030. The strategy focuses on two distinct geographic tracks:

- Europe: 22 new models, of which 16 will be electric. The Renault brand aims for 100 percent electrified sales in this region by 2030.

- International: 14 new models targeted at growth hubs in India, South America, and South Korea. The Group expects 50 percent of Renault brand sales to come from outside Europe by the end of the decade.

A cornerstone of the plan is the RGEV Medium 2.0 electric platform. This modular 800-volt architecture is designed to reduce costs by 40 percent compared to current electric vehicles.

Technical specifications for the 2030 horizon include:

- Charging: Ultra-fast charging capability of 10 minutes.

- Range: Up to 750 km (WLTP) for pure electric versions and 1,400 km with a range extender.

- Software: Transition from Software Defined Vehicles (SDV) to Artificial Intelligence Defined Vehicles (AIDV), with 90 percent of functions updated via Firmware Over The Air (FOTA).

- Powertrain: A third-generation rare-earth-free motor (EESM) delivering 275 hp with 93 percent motorway efficiency.

Renault Group intends to halve factory downtime and reduce energy consumption by 25 percent through the use of an industrial metaverse – a digital twin of all manufacturing sites. The plan involves deploying 350 humanoid robots for low value-added tasks and using AI to supervise 1,000 manufacturing control points. These measures aim for a 20 percent reduction in production costs and a 30 percent reduction in logistics costs.

Francois Provost, CEO, Renault Group, said, “futuREady, our new strategic plan, is a crucial step in the future of Renault Group. In an environment that is even more competitive, we can build on solid fundamentals: our brands, our products and our financial results. Since my appointment as CEO last July, we have been working with the whole team worldwide to develop a plan that will set the Group on the path to robust and sustainable performance, whatever the challenges ahead.”

“Becoming Europe's reference carmaker means setting the ambition to design and produce in Europe products that are best in class in terms of desirability, technology and competitiveness. In an increasingly competitive environment, this means combining performance and innovation with resilience and robust strength,” added Provost.

| RENAULT futuREady PLATFORM EXPLAINED | |

| RGMP small | Modular platform, B & C segments |

| RGEV small | Electric platform, A & B segments |

| RGEV medium 1.0 | Electric platform, C segment 1st generation |

| RGEV medium 2.0 | Electric platform, C & D segments 2nd generation |

| RGMP medium | Modular platform, C&D segments |

| RGMP pick-up | Modular platform, pick-up |

| RGEV medium van | Electric platform, medium LCV |

| APP | Alpine platform |

| RGEA | Adaptation of the Geely GEA platform |

| RGEP | Multi-energy platform, entry level |

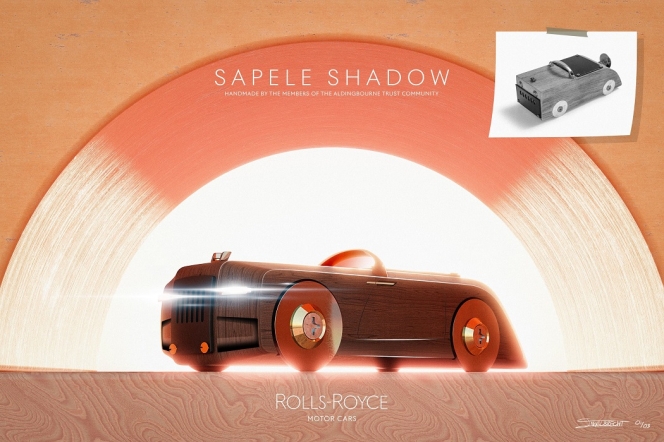

Rolls-Royce Crafts Exclusive Artwork In Support Of Aldingbourne Trust

- By MT Bureau

- March 09, 2026

Rolls-Royce Motor Cars has marked the conclusion of its year-long partnership with Aldingbourne Trust by presenting the charity with a series of exclusive artworks. These pieces were created by the luxury marque’s in-house design team and inspired by a wooden model gifted to Rolls-Royce by the Trust late last year.

That model, named the ‘Sapele Shadow’ after the wood used in its construction, was made by the Wood@Aldingbourne team as a gesture of gratitude when Rolls-Royce delivered its final donation. Now displayed at the company’s Goodwood headquarters, the handcrafted vehicle prompted one of the marque’s designers to reinterpret it digitally using the same advanced rendering software applied for client commissions.

Only three framed prints of this original artwork have been produced, each signed and numbered by the designer. One is set to be displayed in the Aldingbourne Trust café, another has been presented to the Wood@Aldingbourne workshop and the third will be auctioned to support the charity during the Goodwood Members’ Meeting in April.

Wood@Aldingbourne is one of over a dozen social enterprises run by the Trust, which has supported more than 1,500 individuals with learning and physical disabilities since its founding in 1978. Operating as a self-funding environmental group, it collects and repurposes reclaimed wood from local sources, including the Rolls-Royce site. All materials are either transformed into handmade goods for sale or used to fuel the Trust’s biomass boiler.

The relationship between Rolls-Royce and Aldingbourne Trust extended beyond fundraising throughout 2024, with colleagues contributing both time and resources. This ongoing collaboration reflects the meaningful connections formed when employees engage with their chosen House Charity, often resulting in support that endures well beyond the official partnership.

Andrew Ball, Head of Corporate Relations, Rolls-Royce Motor Cars, said, “It was a privilege to work with Aldingbourne Trust as our House Charity in 2024. When we presented the final donation cheque, we received an unexpected gift – a model car made in Sapele wood by the Wood@Aldingbourne team. This delightful model inspired one of our designers to create a unique digital rendering, just as we would for a real client commission. We’re delighted that this artwork will be displayed in the Trust’s café and will also be offered as a significant prize in a fundraising auction. It’s a pleasure to extend our support for this wonderful organisation beyond 2024.”

Abigail Rowe of Aldingbourne Trust said, “We were so appreciative of the fundraising efforts by Rolls-Royce staff, and the tremendous awareness we were able to generate through being their House Charity. It’s wonderful that the relationship has continued through this collaboration, which meant so much to the client who created the original wooden model, and will help raise further money for us. We’d like to thank the whole Rolls-Royce team, and particularly the talented designer who created these images for us.”

Comments (0)

ADD COMMENT